How to Make Sense of Your (Dozens of) Credit Scores

There’s your basic score, but there are plenty of others that you don’t know about and will never see

Back in April, Lanette Andrew needed money to buy equipment for her horse farm in Sherwood, Ore. But she realized she needed to improve her credit score before she applied for a loan.

Like many Americans, Andrew, 54, has seen her income drop during the COVID-19 pandemic. After she missed some bill payments, her score fell from the mid-600s, which is considered barely adequate for getting a loan, to the 590 range, which puts affordable loans out of reach.

To get back on track, Andrew focused on paying down her balances. And she signed up for a credit score monitoring service from the credit bureau Experian, which also gave her scores from Equifax and TransUnion, the other two major credit bureaus. (Cost: $24.99 a month.)

But she discovered that the score information was a bewildering jumble of numbers—with six from Experian alone—that differed by as much as 100 points. The other two credit agencies also provided multiple scores, none of which were the same.

“It’s not at all clear to me why these credit scores are so different, and what I can do to improve them—it’s really frustrating,” says Andrew, who hasn’t applied for a loan because one of her scores is still too low.

The Complexity of Credit Scores

Andrew's confusion over credit scores is shared by millions of Americans. Though most consumers are familiar with their primary three-digit credit score, almost 40 percent don’t know they have more than one score, according to a 2019 survey by the Consumer Federation of America.

“When you add up all the brands and customized versions, each consumer may have more than a hundred different scores, and most of them you may never see or even know about,” says John Ulzheimer, a credit expert who has worked at FICO and Equifax.

The business priorities of the credit industry leave consumers vulnerable to financial harm, advocates say. Because Americans lack full understanding of their credit scores, they’re at a major disadvantage when applying for mortgages or other types of loans.

The credit reporting companies also use credit score data as a marketing hook, barraging consumers with TV ads and email come-ons for credit score updates and credit monitoring programs. That leaves many consumers paying subscription fees for access to a score that may be of dubious value.

Adding to the confusion, the credit industry is marketing new services designed to help you improve your scores. But those programs, such as Experian Boost, may not increase the score you actually need for a particular loan or service.

“There are many other steps consumers should take before signing up for a credit improvement program, such as paying off debts in collection and lowering your use of credit,” says Consumer Reports’ Ejaz.

There are, in fact, several strategies to help you keep tabs on important credit scores as well as improve them, as we explain below.

How Credit Scores Work

To get a clearer understanding of the credit score system, here’s a quick recap of the basics.

Your primary credit score—the three-digit number that indicates your level of creditworthiness—is based solely on the information in your credit report, which is put together by the three credit agencies. That data includes your record for paying bills on time, the size of your credit lines, and the amount you owe in loans, among other items. (For more on understanding your credit record, see “How to Read Your Credit Report.”)

Under the federal law known as the Fair Credit Reporting Act, consumers can dispute errors and inaccurate information on their credit files. Mistakes can happen frequently, as studies have shown.

But unlike credit reports, there is no federal right to free credit scores, says Chi Chi Wu, staff attorney at the nonprofit National Consumer Law Center. There is an exception: The lender must share the credit score it used if you are turned down for credit or charged a higher rate.

The credit industry generally offers consumers limited insight into the formulas used to determine their creditworthiness or the number or type of scores that determine their access to products and services.

“The scoring algorithms are black boxes, and consumers lack information about what they can do to improve their scores,” says Marvin Owens, senior director for economic programs at the NAACP.

Credit scores can also reinforce the financial hurdles faced by those with low incomes, particularly Black consumers and other consumers of color, says Owens. Although the scores themselves are based strictly on the credit reports, some long-standing financial practices—such as charging higher auto loan rates or restricting mortgage lending to populations in certain neighborhoods—tend to disproportionately hurt the credit scores of Blacks and Hispanics, studies have found.

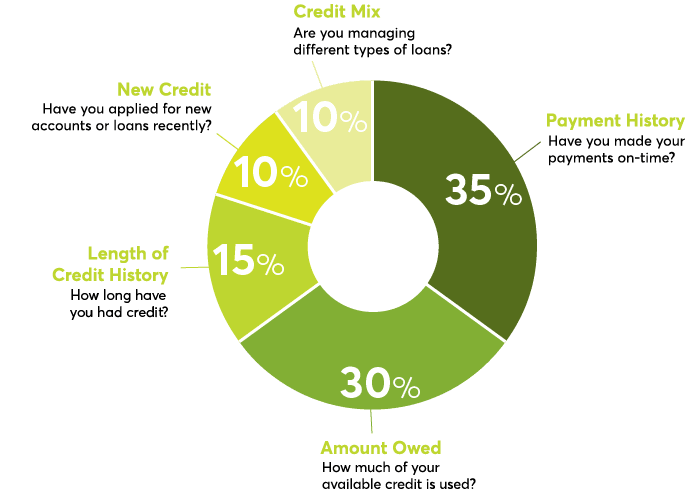

FICO, also known as Fair Isaac Corp., provides the algorithm, or mathematical formula, that credit reporting agencies use to calculate your credit scores. FICO 8 remains the most commonly used score, and it’s the one you often see pop up on your bank or credit card online account. (You can see a breakdown of the FICO 8 formula in the chart above.) But FICO 8 is only one of 28 scores that FICO discloses, according to Tom Quinn, vice president of myFICO.

VantageScore, a joint venture formed by the three major credit bureaus, is also used by many lenders, sometimes in addition to your FICO score. You can often find your VantageScore available for free through financial services or credit score websites.

Focusing On the Scores That Matter

Given these various brands and scoring formulas, it’s unlikely that a consumer will ever see the exact same score that the lender is using to make a credit decision.

“Even if you both are looking at the same formula and brand, your credit data is likely to vary from day to day, producing a different score,” says Rod Griffin, senior director of consumer education and advocacy at Experian.

Some of the biggest differences may crop up when comparing your base FICO 8 score to a FICO mortgage score. Mortgage lenders use older FICO formulas, which are required for mortgages sold to Fannie Mae and Freddie Mac, the government-sponsored entities that purchase most residential home mortgage loans.

These older FICO scores used in mortgage lending will weigh some factors more heavily or lightly than the newer scores. For example, if you have debt collection accounts with zero balances, they won’t be counted by more recent scoring formulas. But under the mortgage score formulas, they will be considered, says Ulzheimer.

When it comes to credit card or auto loan scores, the FICO formulas are adjusted for factors designed to be more predictive for risk in those transactions. Your history of repaying previous auto loans counts in your auto score, while bankcard scores focus on credit card accounts. (More on the key credit scores can be found in the chart below.)

You probably won’t be able to find out in advance which bureau lenders will tap for your credit score. Many lenders also employ customized formulas when making their credit decisions. But for mortgages, it’s more straightforward—lenders will pull your FICO score for mortgage lending from all three bureaus, which are included in a single document called a tri-merge credit report.

Consumers can get access to 28 FICO credit scores, including those from the major credit bureaus and auto and bankcard industry specific scores, at myFICO.com, FICO’s consumer website. (Cost: $19.95 a month and up.)

If you’re in the market for a loan, seeing these scores could be helpful as a rough gauge of creditworthiness. But for most consumers, it’s not necessary to monitor all your available credit scores.

“You can probably get a good general idea of your credit status just by looking at your base score,” Griffin says.

Credit

VantageScore 3.0

Credit Score Improvement Programs

For consumers with thin or subprime credit histories, new options are cropping up that claim to help you improve your scores.

Experian Boost is a free service that counts your utility payments toward your Experian FICO Score. You give Experian read-only permission to connect your bank account or credit card, and see the eligible utility and telecom accounts you select to then add your phone, utility, and streaming services payments to your billing history.

Experian Boost includes only your on-time payments. You can turn off the service at any time.

UltraFICO—a new credit score—is still in the pilot phase. (You can sign up to be alerted when it rolls out.) In addition to traditional credit bureau data, this score also looks at your banking history to determine how well you manage your money, using measures such as the amount you keep in savings and whether you bounce checks. Consumers can determine which alternative data to include.

One new service, eCredable Lift, allows you to add utility and phone payments to your TransUnion credit report. (Cost: $24.95 a year.) Unlike Experian Boost, eCredable Lift reports both positive and negative data. This means the participant needs to stay current on their payments to benefit their score. Late payments will harm their score.

“Lenders are more likely to consider payments reported by Lift due to the completeness of the reporting, even though it requires the participant to opt-in to share these accounts,” says Steve Ely, CEO of eCredable.

You should also expect only modest gains to your score—Experian Boost customers see 13-point increases on average, according to Griffin. For some consumers, however, that could be enough to move you into a higher credit score level.

While these programs could be helpful, be aware that you will be giving up personal information to the credit bureaus, says Wu of the National Consumer Law Center.

You also need to realize that the scores that could be improved may not be the same scores considered by your particular lender, who may use a different scoring formula or pull your credit history from a different bureau. Because of the requirement to use older scoring formulas, mortgage lenders will not consider scores from these programs, Ulzheimer says.

Some consumers have also had difficulty connecting their bank or utility payments to these programs. Oregon horse farm owner Andrew has struggled for several months to get her cell phone and utility payments counted by Experian Boost.

“Two customer reps promised back in April that the payments will be processed, but it hasn’t happened,” Andrew says.

Experian spokesperson Sandra Bernardo responds that the balance on Andrew’s Experian credit report was from “the most refreshed report.” But Andrew remains dissatisfied.

How to Improve Your Credit Score

Although there’s no quick fix to a poor credit score, taking these basic steps can help improve those numbers over time.

Check your credit report. This report is the foundation of your score, so make sure the information is accurate. Normally you can get one free credit report from a different reporting agency each year, which you can space out every four months to ensure regular updates. But because of the pandemic, you can request weekly reports from all three agencies through April 2021. Still, most people need to look at their reports just once a year, Wu says.

It’s best to go to AnnualCreditReport.com when requesting your report, says Leonard Bennett, a consumer litigation attorney in Newport News, Va. If you instead request your report from one of the major credit bureaus, you may be subject to forced arbitration, which could limit your ability to take legal action in the event of problems or errors in your files, Bennett says.

Dispute any errors. If you spot a problem, such as an incorrect address or unrecorded bill payment, file a dispute promptly. You can do this online, but consider mailing in the form, with return receipt requested, to have a record of the dispute, says Wu.

You may need to be persistent. By law, the credit agencies are supposed to have 30 days to respond, but the Consumer Financial Protection Bureau has said it will not enforce (pdf) that deadline during the pandemic because of staffing challenges at the credit bureaus.

Consumer advocates recently urged the CFPB to enforce the deadline, noting that consumer complaints about delays in resolving disputes have soared in recent months. But so far the CFPB has not changed its policy. The CFPB did not respond to a request for comment.

Stay on top of your finances. Two steps alone—making timely payments and minimizing your use of credit—will go a long way toward improving your credit score. Those two factors alone account for 65 percent of the FICO 8 score, says Ted Rossman, industry analyst at CreditCards.com.

If you’re having trouble managing your debts, consider getting help from a nonprofit credit counseling agency. You can find one at the National Foundation for Credit Counseling.

Plan ahead if you’re borrowing. If you’re looking to take out a loan, be careful to avoid moves that could hurt your credit score. Applying for a new credit card, for example, could result in a hard inquiry on your credit report, which is likely to ding your score.

It also makes sense to avoid closing credit card accounts. That would reduce your available credit, thereby raising your utilization rate, another factor that could hurt your score, says Rossman.

Once you’ve secured your loan, you can feel free to reshuffle your accounts. With good credit management, your score will eventually rebound.