Did you know your credit score is factored in while determining your loan interest rate? The higher your score, the lower would be your loan interest rate and vice versa. For example, a prominent government bank charges a 10 basis point premium for home loan borrowers with poor credit scores. That is why it is critical to know your credit score as that has a direct bearing on your financial health. Let us discuss a few important things related to credit scores.

What is a credit score?

This is a number which ranges between 300-900 and is computed by rating agencies like CIBIL and Experian. If you take a loan or a credit card from a bank or a financial institution, your lender sends your repayment details to the credit agencies on a monthly basis. The credit agencies use this information to compile your credit history and determine your credit score. Disciplined repayments help in increasing your credit score, while late or incomplete payments bring your score down. Whenever you apply for a loan, your lender takes into account your credit score to evaluate your creditworthiness. If your credit score is above 750, you’re likely to get good loan offers.

Credit score linked to loan interest rate

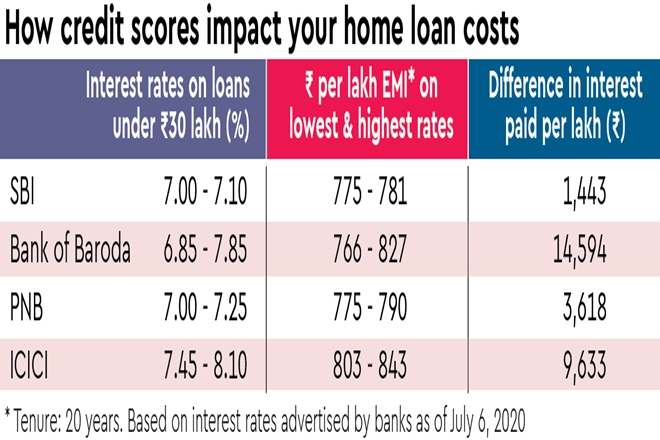

Banks want to understand the risk of lending you money. They check your credit history, which includes your credit score, to know this. Your credit report contains the details about all your previous loans and credit card repayments. If you’ve repaid all your loans in full on time, your bank will see you as a responsible borrower, and hence, could offer you lower interest rates. But if you’ve defaulted on a loan or have a patchy repayment history, your bank will charge a higher interest rate to mitigate the additional lending risk resulting in higher EMIs for you. See table to know how your credit score could impact your home loan costs:

Know your credit score

Search “Free Credit Score” on the internet to go to any financial website where you can check your credit score for free on unlimited occasions after entering your PAN and phone number. You can also visit the websites of credit agencies and download your credit report for free once a year.

If you’re planning to take a loan, check your credit score before applying for it to avoid any unpleasant surprises. If you have been servicing a loan or using a credit card, check your credit report regularly to find how your repayments have impacted your credit score. You should also check your credit score if you are a guarantor to someone else’s loan. If you have never taken a loan or been a loan guarantor or used a credit card, you will not have a credit score. If so, there’s nothing to worry about. When you take a loan, your credit history will start building up which will get reflected in your credit score.

How to improve credit score

If you do not have a credit history, you can apply for a basic credit card or even make a purchase on EMIs to develop it. If you’re not eligible for a credit card, check whether you can get one against your fixed deposit. This facility is offered by a majority of banks. Once you have a credit history and a credit score, timely repayment of your card or loan dues will boost your score.

You can set standing instructions for the auto-debit of your credit card dues or loan EMIs to ensure timely repayments, save on penalty charges and improve your credit score. But use your credit card carefully and avoid regularly using more than 30% of your spending limit. When making a big-ticket purchase using your credit card, repay as soon as possible. Failing to do so will pull down your credit score. The older your credit history, the better it is for your credit score as it indicates you deal with long-term credit commitments in a responsible manner.

Try not to miss a single loan repayment even if you go through a temporary financial crisis as a loan default or settlement is likely to be detrimental to your credit score. If you notice any errors or discrepancies in your credit report, reach out to the credit rating agency at the earliest for correction. As such, make it a habit to check your credit score on a monthly basis.

(The writer is CEO, BankBazaar.com)