We recently released an update regarding the Australian Government’s plan to, in effect, remove the current responsible lending obligations from the National Consumer Credit Protection Act 2009 (Cth) (NCCPA), other than for certain higher risk products (Proposed Reforms). You can read that update here, including our assessment of the impact the Proposed Reforms will have on lenders and other key industry players (including neo-banks and other fintechs looking to disrupt consumer credit).

The Government has since released draft legislation for the Proposed Reforms. The draft legislation was released on 4 November 2020 and is open for consultation until 20 November 2020.[1] In this update, we provide an overview of the draft legislation for the Proposed Reforms and what lenders and other key industry players may need to start considering in order to prepare for their implementation.

What is proposed

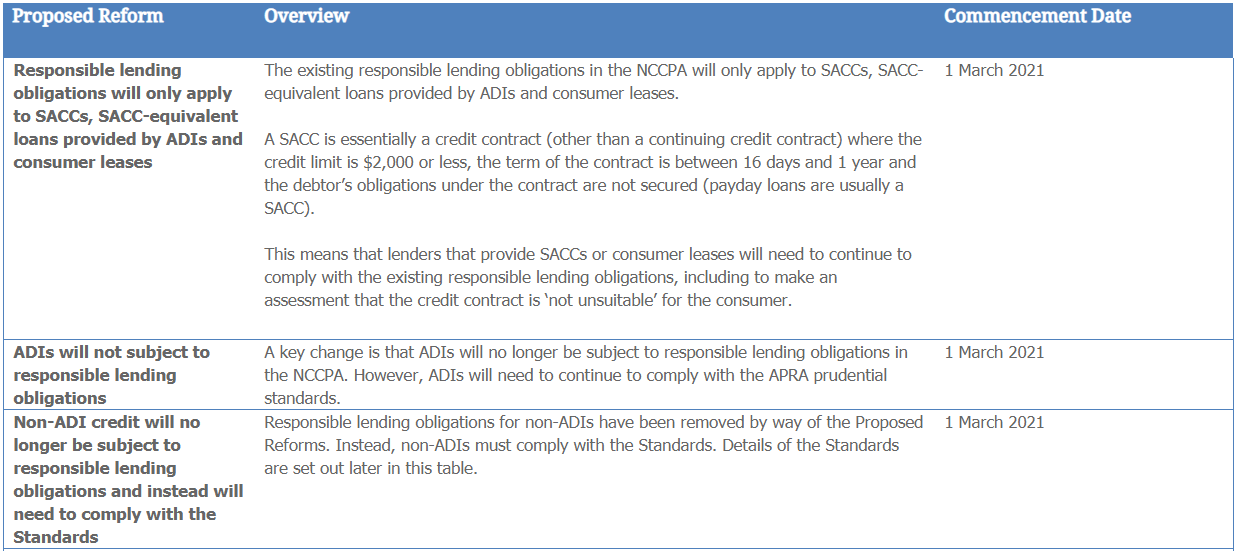

As expected, at a high-level, the draft legislation removes the existing responsible lending obligations from the NCCPA for credit contracts, except in relation to small amount credit contracts (SACCs), SACC-equivalent loans by ADIs and consumer leases. For all other credit, the Proposed Reforms will remove responsible lending obligations for ADIs, and instead impose lending standards for non-ADIs that reflect a new ‘risk-based’ regulatory framework for consumer credit.

ADIs are already subject to the prudential regulatory framework under the Banking Act 1959 (Cth) that is administered by the Australian Prudential Regulation Authority (APRA). Removing the existing responsible lending obligations in the NCCPA for ADIs seeks to ensure that ADIs are no longer subject to two frameworks.

The suite of draft legislation for the Proposed Reforms includes:

- NCCP (Supporting Economic Recovery) Bill 2020 (Bill);

- NCCP (A new regulatory framework for the provision of consumer credit) Regulations 2020 (Regulations); and

- Non-ADI Credit Standards (Standards).

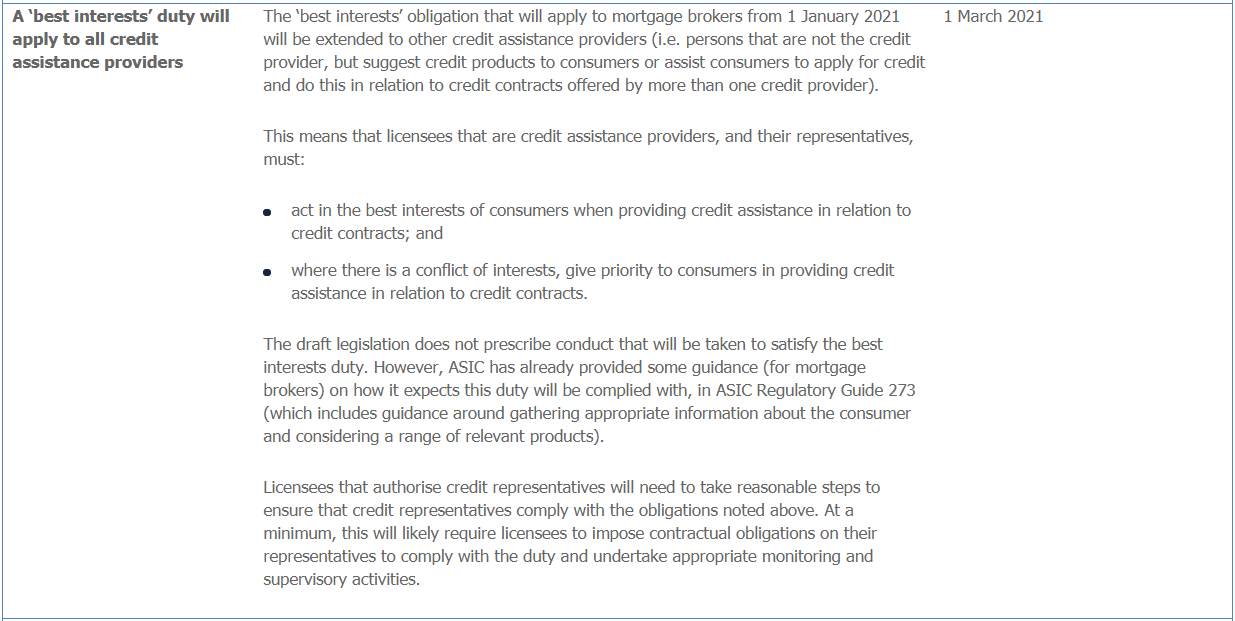

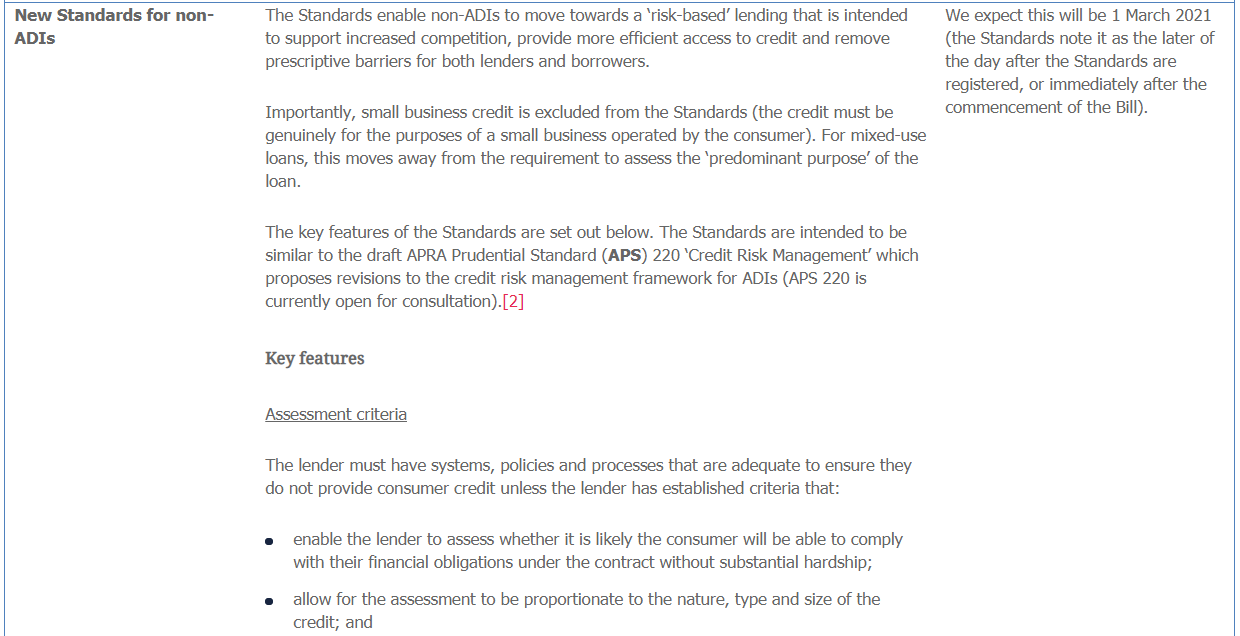

An overview of the key changes

What your business needs to start considering

As the Proposed Reforms come into effect from 1 March 2021, lenders (particularly non-ADI lenders) will need to start thinking about any updates that need to be made (or can be made) to their systems and processes to ensure consistency and compliance with the Proposed Reforms, including the assessment criteria outlined in the Standards.

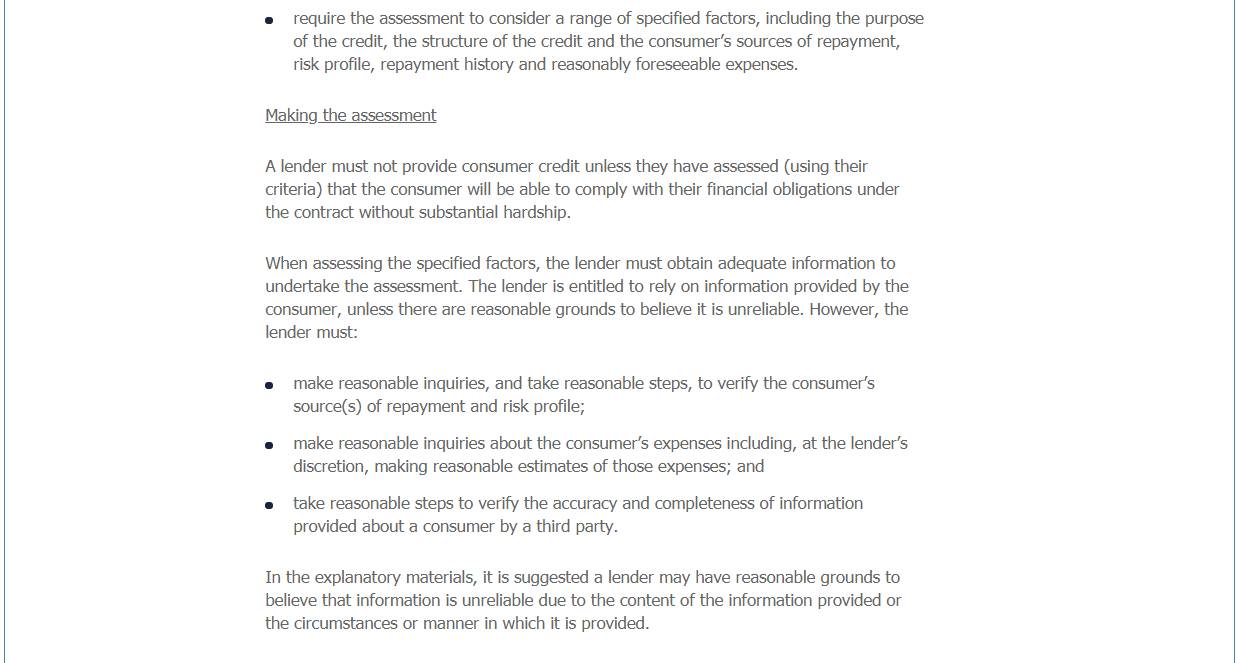

Although a key feature of the draft legislation is to increase borrower responsibility for providing adequate information to lenders, before a lender revises their current processes they will need to consider the following:

- The appropriate thresholds for determining whether or not a consumer can repay a loan without ‘substantial hardship’ (including by reference to the circumstances prescribed in the Standards).

- How the lender will determine whether there are reasonable grounds to believe information provided by the consumer is reliable or not. This will likely require at least some level of assessment of the information provided and the circumstances in which it is provided.

- The processes the lender requires in order to make reasonable inquiries in respect of sources of repayment, consumer risk profiles and consumer expenses (and to verify information provided by a third party). We expect that at least some existing industry practices are likely to be maintained in order to meet these obligations, however an increasing culture of compliance may change this over time.

- The lender’s other obligations, including the general obligation to ensure credit activities are engaged in efficiently, honestly and fairly and the upcoming design and distribution obligations. The latter in particular will require lenders to have processes in place to ensure credit products are distributed to consumers that fall within the defined target market.

- The lender’s own risk appetite and the level of inquiries they need to make to satisfy themselves that a loan fits into that risk appetite (so they do not unnecessarily incur or increase credit risk).

Accordingly, while the reforms are intended to make it easier for lenders to provide credit, some level of inquiry by lenders will continue to be required. This may mean that, at least in the short term, a conservative view will be taken by some lenders.

However, the ability to place greater reliance on information provided by consumers may be attractive to fintechs and other new entrants to the consumer credit space, including those who do not yet have an established responsible lending program (as there is an opportunity, under the Proposed Reforms, to build a more streamlined credit assessment process).

We expect that the Proposed Reforms will allow some lenders to gain a competitive advantage, by offering a more simplified credit assessment process and by reducing the time needed to assess and extend credit. On the other hand, we expect that many incumbent players will not be able to ‘relax’ their current procedures to a material extent (or will simply choose not to do so), and we expect this will lead to a continuation of the general theme of greater competition in this area.

The Proposed Reforms have already been critically analysed in the media for the effect they may have from a consumer protection perspective, so the Government will no doubt take this into consideration in finalising its consultation process.

Next steps

Consultation on the Proposed Reforms is open until Friday 20 November 2020. Once the consultation period expires, the Government will take into consideration any submissions in finalising the legislation for the Proposed Reforms.