Subprime lender Amigo makes £1.1m loan provision in Ireland

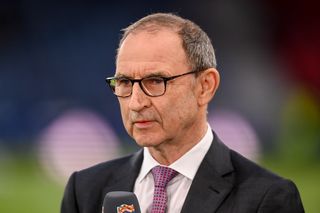

Different approach: CEO Gary Jennison said Amigo had made considerable progress

Troubled UK subprime lender Amigo has set aside the equivalent of 23pc of its loan book in Ireland for impairments here.

It had a gross loan book of £4.7m (€5.4m) in Ireland at the end of December, according to third-quarter results published yesterday by the company. There is no previously published impairment figure for Amigo’s business in Ireland.

Amigo started offering loans in Ireland in early 2019.

By March last year, it had more than 4,000 customers here, with a total loan book of about €8.2m. It now has fewer than 3,000 customers in Ireland.

The company has suspended new lending across the UK and Ireland as it faces intense regulatory scrutiny.

In its third-quarter results, the lender said it has set aside £1.1m as an impairment provision for its Irish loan book.

Amigo, which last year appointed a new CEO and CFO, reported a 37pc fall in revenue in the nine months to the end of 2020, and warned it faces "material uncertainties" while it waits to hear if its scheme to handle compensation payments for a huge backlog of customer complaints is approved.

The company, which saw revenues drop to £137.5m (€159.1m) over the period, also reported that its net loan book has been reduced by over 40pc, while 62,000 of its customers were on loan payment holidays. It has paused all new lending until the regulator approves its planned approach to restart it.

Read more

The lender has had to provision millions of pounds to handle compensation payments caused by a large number of customer complaints and has been investigated by the UK’s financial regulator over how it assesses customer creditworthiness.

This has hampered Amigo's ability to operate and it has warned that unless its proposed scheme for dealing with compensation payments is approved, it may not survive.

Amigo’s total net loan book stood at £412.2m at the end of December, which was a near 43pc decrease year-on-year.

CEO Gary Jennison insisted Amigo made “considerable progress” during its third quarter with a new board that he said enables a “fresh and different approach”.

"When I started as CEO over five months ago, I knew we had to do something significant to deal with the complaints we were getting,” he said.

“We're very focused on doing the right thing for all our customers, including the 700,000 past borrowers and guarantors who no longer have a loan with us,” the CEO added.

Mr Jennison claimed that Amigo has a “valuable role to play” in the “non-standard” lending sector.

“We have real purpose to help provide financial inclusion to millions of adults,” he said.

Amigo requires borrowers to have their loans guaranteed by a friend or family member who remain on the hook for the money if the borrower can’t make payments.

It charges almost a 50pc interest rate, compared to rates of below 10pc that would typically be charged for similar borrowings by mainstream lenders.

Additional reporting: Reuters.

Join the Irish Independent WhatsApp channel

Stay up to date with all the latest news