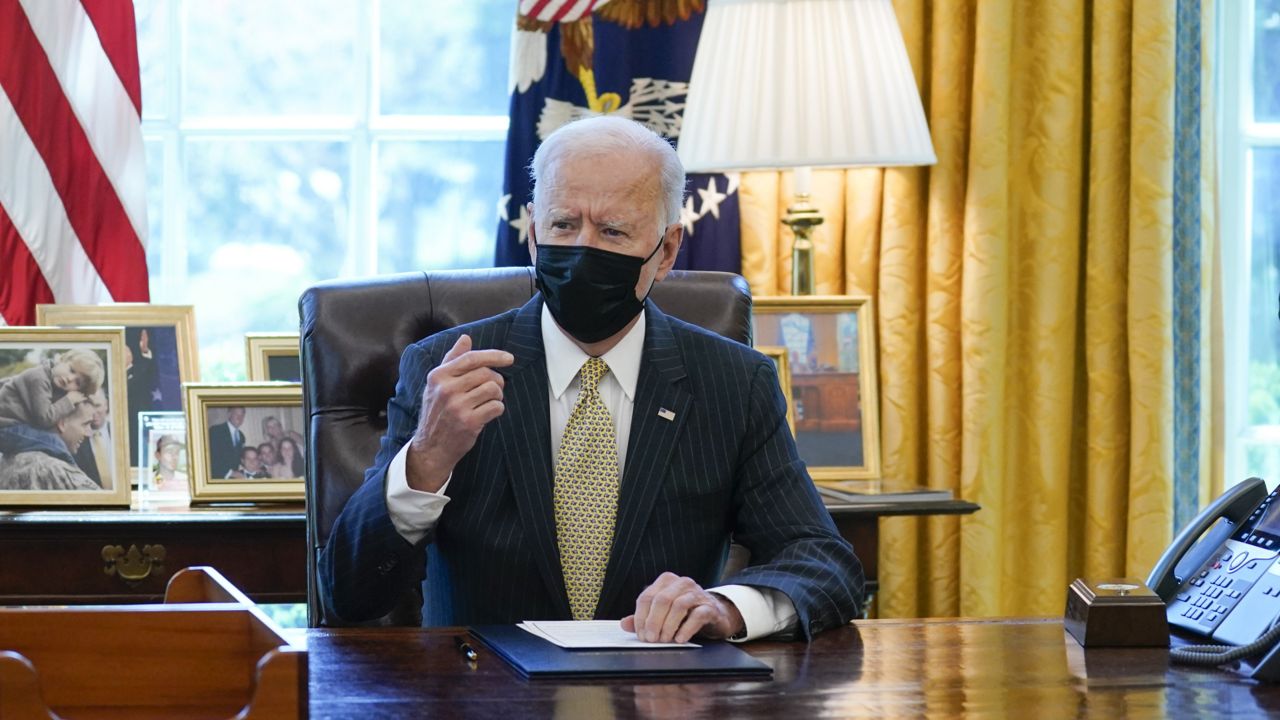

President Joe Biden on Tuesday extended the deadline for the pandemic-era Paycheck Protection Program (PPP) by two months, calling small business owners the “backbone” of the American economy.

With Biden’s signature, the application deadline for the program moves to May 31, which was set to expire on Wednesday, March 31. The federal government now has until June 30 to process the applications.

“I want to thank Senators Cardin, Shaheen, Rubio and Collins for their work in the Senate, it was a bipartisan effort,” Biden said from the Oval Office. Senators Marco Rubio (R-FL), Susan Collins (R-ME), Ben Cardin (D-MD), and Jeanne Shaheen (D-NH) authored the original Paycheck Protection Program under the CARES Act last year; the latter three also introduced the PPP Extension Act of 2021 to the Senate.

Last week, the Senate passed the bill 92-7 to extend the deadline for business owners to apply for forgivable loans in the program, having already passed the House on a widely bipartisan 415-3 vote.

“PPP has supported millions of small businesses through the pandemic, and it is clear that the program must continue to be a lifeline for small businesses and nonprofits,” said Senator Cardin, chair of the Senate Small Business Committee, in a statement. “It is vital that we in Congress continue working in a bipartisan manner to fine-tune PPP in the weeks ahead to make the program more fair and equitable.”

“The PPP has been an enormous success, sustaining millions of small businesses and tens of millions of jobs,” Senator Collins added. “Small businesses need this assistance to stay afloat and continue paying their employees. I am pleased that Congress acted before the PPP expired in order to prevent an interruption in the program and give small business owners a crucial two-month extension to access this lifeline.”

Sen. Rubio tweeted that he was hearing from small business owners who received PPP loans, and thereby "saved their company & kept workers employed" in his homestate.

First rolled out in the earliest days of the coronavirus pandemic and renewed in December, the program was meant to help keep Americans employed during the economic downturn. The loans are structured so that they can be fully forgiven if the recipient attempts to maintain similar levels of employment and uses at least 60% of the loan to cover payroll costs. The remaining 40% can be spent on rent, utility costs and other operational expenses.

Biden’s American Rescue Plan, signed into law this month, included another $7.25 billion for the program, but at the time did not extend the timeline for getting the loans.

Despite having been first approved under the CARES Act last year, data released in late December showed many minority owners desperate for a relief loan didn’t receive one until the PPP’s last few weeks, while many more white business owners were able to get loans earlier in the program.

In mid-February, the Biden administration made changes to the program in an effort to offer more federal assistance to "mom-and-pop" stores. The renewed program established a temporary, two-week window in which only businesses with fewer than 20 employees could apply for the forgivable loans.

The Small Business Administration reports that it has approved nearly 7.9 million loans totaling about $704 billion.

The Associated Press contributed to this report.