Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

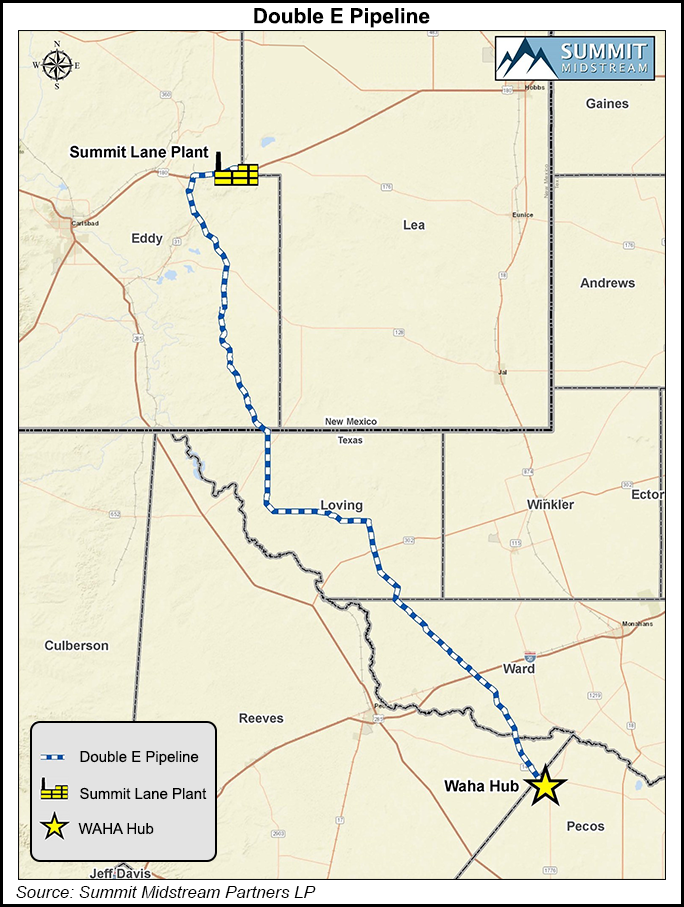

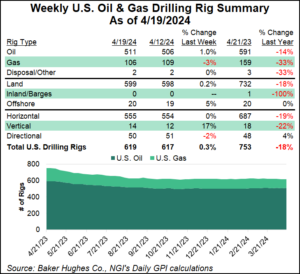

Summit Secures Double E NatGas Pipe Financing, but Permian Outlook Lower for 2021

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |