As mortgage refinance origination volumes

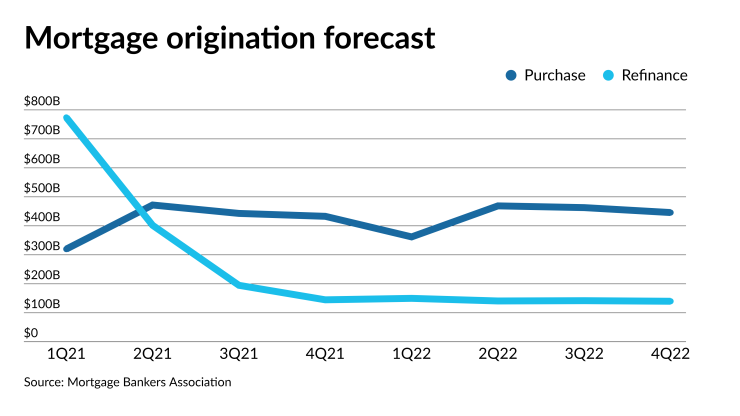

The Mortgage Bankers Association's March forecast predicts overall volume will slip in each of this year's four quarters, from $1.1 trillion in the first quarter, down to $578 billion in the fourth.

Projected refi originations over the same time frame are expected to go from $774 billion in the first quarter to just $145 billion for the fourth quarter.

So the timing might be a little unusual for Black Knight to update its Capture lead analytics product, in order to integrate it with the Optimal Blue product and pricing engine

But that is precisely the thinking behind the roll-out of this offering, given that originators will need robust analytics to identify and prioritize specific leads, said Rob Kessel, managing director, hedging and loan trading services at Black Knight.

"Additionally, monitoring home equity for cash/out opportunities, not just rate/term opportunities becomes that much more important to bolster production volume," he added. "Last year, the great bulk of outstanding servicing was refinanceable and servicers couldn't absorb what supply they had let alone analytics to suggest more."

In fact, Black Knight quantified that 2.3 million possible refinance borrowers were lost by lenders to their competitors in the fourth quarter 2020 alone.

With the change, users can identify actionable leads, determine the right time for outreach to the customer and calculate personalized loan pricing.

Separately,

Accessible via iOS and Android mobile apps as well as via web browser for desktop and tablet, the toolkit can best be described as a unified workflow for loan officers. It allows them to do the entire end-to-end qualification process within that system, said John Whipple, product manager at Blend in an interview.

"Especially with the tools around prequalifying or preapproving borrowers, we see this as a super helpful utility for loan officers working with borrowers that are doing a home purchase," said Whipple.

Meanwhile, in order to help its loan officers capture more purchase business, Embrace Home Loans, a retail lender based in Middletown, R.I., has rolled out the

"We needed a solution that was LO-centric and pliable enough to let our team continue serving customers and Realtors in the way they prefer," Meghan Handy, Embrace's customer experience director and vice president, said in a press release.

Embrace will be the first lender to use SimpleNexus in conjunction with a new mobile disclosures integration with First American Docutech, the announcement said. The new tech also allows borrowers to pay for appraisals in-app using a credit card.

"Embrace has been an amazing partner and has pushed us to extend SimpleNexus' feature set," said the fintech's founder and CEO Matt Hansen in the press release. "We can't wait to see how loan officers and borrowers respond to the improved experience."