Material science company Corning's (GLW 1.07%) sales came roaring back in the fourth quarter and the company looks set for a very strong year. The company has a lot of good things going for it at the moment, but does it all add up to make the stock a buy? Let's take a closer look.

End markets firmly in recovery mode

The table below outlines the progression of the recovery in Corning's sales in the second half of 2020. The company also has many positive sales drivers in place to take it through 2021 and beyond. If it isn't 5G networking spending, it's the use of Corning's Gorilla Glass and ceramics in mobile phones from Samsung and Apple. If it's not large-size television panel production, it's gasoline filter sales.

|

Business Segment |

Full-Year Sales 2020 |

Fourth Quarter YOY Change |

Third Quarter YOY Change |

Activity |

Notes |

|---|---|---|---|---|---|

|

Display technologies |

$3.17 billion |

6% |

4% |

OLED and LCD displays for televisions, notebooks, and monitors |

Large-size television panel production shifting to Corning's large plants in China |

|

Optical communications |

$3.56 billion |

8% |

(10%) |

Fiber optic and cable for networking |

5G spending |

|

Environmental technologies |

$1.37 billion |

19% |

(5%) |

Ceramics and materials for use in emission control |

Regulatory pressure on automotive manufacturers to adopt environmentally friendly technology |

|

Specialty materials |

$1.88 billion |

20% |

23% |

Glass and materials used in smartphones, semiconductors, tablets, aerospace, defense, and other industrial applications |

Use of tough glass in mobile phones |

|

Life sciences |

$998 million |

7% |

(13%) |

Life science vessels and equipment |

Technology that helps customers create vaccines and therapies for COVID-19 |

|

Total |

$11.45 billion |

17% |

2% |

N/A |

N/A |

Data source: Corning presentations, author's analysis. YOY = year over year.

Simply put, Corning has a lot of sales and earnings drivers in 2021, and Wall Street is expecting its sales to grow 13.8% in 2021 before moderating to 5.2% growth in 2022. Meanwhile, earnings per share (EPS) is expected to follow suit in expanding from $1.39 in 2020 to $1.96 in 2021, and $2.19 in 2022. Similarly, free cash flow is expected to increase from $948 million in 2020 to $1.4 billion in 2021, and then to $1.55 billion in 2022.

Together, these figures demonstrate that Corning trades on some very attractive 2022 valuations, and it's hard not to argue that the company looks like a good value.

However, I'm going to try.

| Corning Metric |

2020 |

2021 Est. |

2022 Est. |

|---|---|---|---|

|

P/E ratio |

27x |

19.1x |

17.1x |

|

Price to free cash flow |

30.2x |

20.5x |

18.5x |

Data source: Yahoo! Finance, author's analysis.

The key number to focus on

The big concern with Corning is not its end markets or even its ability to grow sales. Instead, it's a question of maintaining its profit margin in the face of growing competition from production in emerging countries like China and India. The question boils down to its gross profit margin -- in other words, the profit that's left after the total cost of goods is taken out.

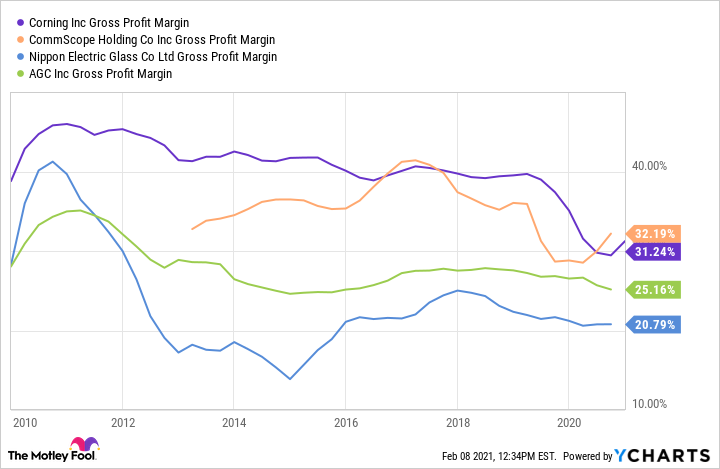

If an industry has rising gross profit margins it's a good sign that companies within it have good pricing power, while if margins are falling it's a sign of intense pricing competition. With this in mind, let's take a look at the evolution of Corning's gross margins alongside some of its key competitors as named in its annual 10-K filing with the SEC. (In case you are wondering, in the chart below AGC stands for Asahi Glass Company.)

Unfortunately, it does look like Corning's industry-leading gross margins are under long-term pressure.

Data by YCharts

That said, current pricing conditions appear to be favorable. Discussing the matter on the recent earnings call, CFO Tony Tripeny sees tightness in glass supply leading to favorable "supply/demand dynamics" from which "we are experiencing a very favorable pricing environment."

Image source: Getty Images.

Tripeny went on to outline expectations that the pricing environment would remain favorable for at least the next "several quarters" due to a combination of tightness in supply chain issues in the industry, the profitability problems that competitors are facing in the current pricing environment, and because "display glass manufacturing requires periodic investments in existing capacity to maintain operations." As such, don't be surprised if gross margin expands in the coming quarters.

What's next?

There's no guarantee that the pricing environment will remain favorable. Once competitors sort out their supply chain issues and invest in expanding capacity, pricing pressure could resume and eat into Corning's profits. If you will pardon the pun, the optics look great for Corning in 2021, but investors should be cautious about its long-term prospects.

This article represents the opinion of the writer(s), who may disagree with the "official" recommendation position of a Motley Fool premium advisory service. We're motley! Questioning an investing thesis -- even one of our own -- helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.