HEADLINES

- New issuance of European collateralised loan obligations (CLOs) peaked at just under €4 billion in October 2020 from 12 deals—the highest monthly level since October 2019

- European CLO new issuance declined 26% year-on-year, with refinancing volumes falling from €6 billion in 2019 to zero in 2020

- By the end of March 2020, credit ratings on an estimated 10% of loans held by CLO managers were downgraded or put on notice of downgrade—however, the rate of loan downgrades eased and stabilised in the second half of 2020

European CLOs ploughed through the worst of the cycle in 2020, despite COVID-19 uncertainty, ratings downgrades and loan pricing volatility, with CLO managers returning to market to secure investor support and resume normal dealmaking following the onset of the pandemic.

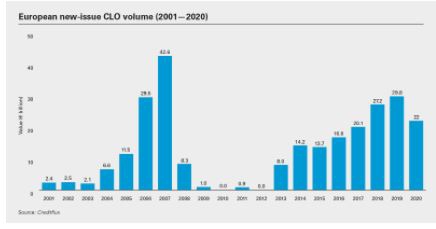

European new-issue CLO volume in 2020 fell by 26%, year-on-year, to €22 billion—down from €29.8 billion in 2019. CLO refinancings played a big part in this decline, dropping from €6 billion in 2019 to zero in 2020.

Some may have feared the worst in March 2020, when leveraged loan prices plummeted, but CLOs have shown yet again (as they did in the aftermath of 2008) that they are designed to operate smoothly through economic cycles, to the point where we can say that the events of 2020 proved to be barely a flesh wound for the CLO market.

While, by the end of March, credit ratings on an estimated 10% of the loans held by CLO managers were either downgraded or put on notice of downgrade, the rapid recovery of the leveraged loan market—combined with the ability of CLO managers to avoid riskier sectors and otherwise challenging positions—has already seen CLO portfolios recover significantly, both from a ratings and an over-collateralisation perspective.

Banks providing 'warehouse' facilities to CLOs—lines of credit that allow CLOs to buy up portfolios of loans before they are packaged into tranches and sold on to investors—were also cautious midway through 2020, as investor appetite for buying up CLO tranches waned. According to the Financial Times, between 40 and 50 'warehouse' lines were outstanding by the end of March 2020.

But there have been signs of recovery since the first round of COVID-19 restrictions were implemented in the summer: The primary CLO new issuance market was back in near full swing by October 2020, when €4 billion of CLO new issuance was priced from 12 deals—the highest monthly level since October 2019. Liability spreads also tightened through the year, to the point where US-dollar deals have once again been marketed in Europe.

The start of the vaccine rollout in December 2020 provided another boost for markets globally, and the market expectation is for reset and refinancing activity to return to Europe in 2021, as has already been the case in the US.

Lessons learned

The resilience of CLOs is partly thanks to lessons learned following the 2008 financial crisis. Prior to the collapse of Lehman Brothers, which precipitated the 2008 credit crunch, CLO portfolios included a higher level of high yield bonds, and managers had longer windows in which to reinvest interest payments and proceeds from existing portfolios into additional loans. These structures were dubbed 'CLO 1.0'.

From 2010 onwards, however, CLOs adapted by narrowing windows for reinvesting proceeds, reducing or eliminating high yield bonds from asset pools and strengthening credit quality and support. These post-credit crunch vintages have been labelled 'CLO 2.0'.

CLOs have also held firm thanks to other features of the product's structure, including the typical requirements for 90% of a portfolio to comprise senior secured loans, portfolio diversification by borrower and by industry, restrictions on illiquid loans and the increasing prominence of ESG criteria, which have protected CLOs from investments in riskier sectors.

COVID-19 has also sparked a new wave of CLO evolution. Although CLOs had a fair degree of flexibility when faced with restructurings, there were some restrictions on the ability of CLOs to 'follow their money' when their underlying credits have encountered distress. This has historically put CLO managers at a disadvantage in restructuring situations versus hedge funds, which do not face the same limitations.

Post-lockdown deals, however, have started to adjust, giving CLOs more room to take part in rescue financings and restructurings. According to S&P Global, a recent deal by CLO manager CVC included documentation that gave the company scope to acquire loans in default, insolvency or restructuring scenarios if the purpose was to mitigate losses. CLO managers Redding Ridge and GSO are reported to have secured similar terms.

In the immediate aftermath of lockdowns, CLOs also adapted by launching short-dated CLOs, with non-call periods of 12 months rather than two years, to take advantage of sharp drops in loan pricing in the secondary markets. Permira and Oaktree are among the managers who moved quickly to build portfolios of deeply discounted loans in the secondary market. By the fourth quarter of 2020, deals were back to the typical two-year non-call period and shorter reinvestment periods also became a feature of activity.

A focus on sustainability

In the midst of the CLO market's adaptation to the immediate challenges posed by COVID-19, the industry has also continued to make progress in the areas of ESG and sustainability. CLOs are an important source of financing for the US$100 trillion needed to deliver the 2030 Sustainable Development Goals. Banks are accelerating their underwriting of sustainability-linked loans, but need to recycle their capital by moving these loans into the capital markets via CLOs.

The G20's White Paper on sustainable securitisation (co-authored by White & Case) recommended that G20 central banks should start buying sustainable assets. This recommendation has been adopted by the European Central Bank, starting in 2021, which paves the way for the next-step change in the growth of the sustainability-linked loan market.

VodafoneZiggo's debut green bond issuance in December 2020 is the latest example of the largest leveraged issuers joining the sustainability party, and further evidence that this will continue to be an important driver of future CLO new issuance.