- News

- Business News

- India Business News

- Loan frauds surge to 90% in FY19

Trending

This story is from December 28, 2019

Loan frauds surge to 90% in FY19

Representative image

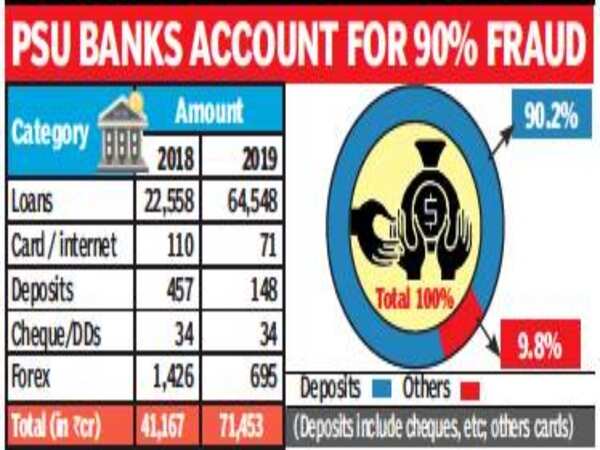

BENGALURU: Loan frauds as a percentage of total banking frauds jumped to 90% in fiscal 2019 from 55% in fiscal 2018 after regulatory standards were changed for banks reporting non-performing assets (NPAs). Loan frauds increased year-over-year to Rs 64,548 crore in 2019 from Rs 22,558 crore, even as frauds in other segments — such as debit & credit cards, online banking and forex — declined.

Interestingly, the share in these frauds of public sector banks (PSBs) is as high as 90% in terms of the amount lost. And for high-value frauds — that is, Rs 50 crore or more — the share of PSBs rose higher to 91.6%. “This mainly reflects the lack of adequate internal processes, people and systems to tackle operational risks,” the RBI said in a recent report.

It also said that the “spike in the number of cases was because of the time period when banks chose to report the fraud, whereas the graph would be trending lower if analysed on the basis of the date of occurrence of the fraud”. This could indicate a lag in reporting on the part of the bank or a delay in detecting the fraud.

The report also pointed out that the sharp spike in loan frauds this year was because of a change in regulations that called for tighter scrutiny of NPAs to ensure early detection of fraudulent loan accounts. “In February 2018, the government issued a framework for timely detection, reporting and investigation relating to frauds in PSBs, which required them to evaluate NPA accounts exceeding Rs 50 crore from the angle of possible frauds, to supplement the earlier efforts to unearth fraudulent transactions. This appears to have caused the sharp jump in reported frauds,” the report noted.

Another concern is the rise in the frauds in the retail loan segment, traditionally considered a low-risk segment. Bankers said the trend of instant five-minute online loans, same-day loans, etc, are the reasons for lower due diligence, resulting in higher frauds.

On the positive side, cases of people losing money due to skimming of debit cards at ATMs or PoS machines, online banking frauds and others trended lower. Internet/card fraud declined 35% to Rs 71crore, indicating that the RBI’s push for banks to move from magnetic stripe to EMV chip-based cards, that are more secure, has worked in preventing frauds.

The report further showed that deposit frauds also tended lower to Rs 147 crore from Rs 457 crore a year earlier, indicating that banks are enforcing tougher KYC norms to prevent money laundering, roundtripping and other frauds.

Interestingly, the share in these frauds of public sector banks (PSBs) is as high as 90% in terms of the amount lost. And for high-value frauds — that is, Rs 50 crore or more — the share of PSBs rose higher to 91.6%. “This mainly reflects the lack of adequate internal processes, people and systems to tackle operational risks,” the RBI said in a recent report.

It also said that the “spike in the number of cases was because of the time period when banks chose to report the fraud, whereas the graph would be trending lower if analysed on the basis of the date of occurrence of the fraud”. This could indicate a lag in reporting on the part of the bank or a delay in detecting the fraud.

The report also pointed out that the sharp spike in loan frauds this year was because of a change in regulations that called for tighter scrutiny of NPAs to ensure early detection of fraudulent loan accounts. “In February 2018, the government issued a framework for timely detection, reporting and investigation relating to frauds in PSBs, which required them to evaluate NPA accounts exceeding Rs 50 crore from the angle of possible frauds, to supplement the earlier efforts to unearth fraudulent transactions. This appears to have caused the sharp jump in reported frauds,” the report noted.

Another concern is the rise in the frauds in the retail loan segment, traditionally considered a low-risk segment. Bankers said the trend of instant five-minute online loans, same-day loans, etc, are the reasons for lower due diligence, resulting in higher frauds.

On the positive side, cases of people losing money due to skimming of debit cards at ATMs or PoS machines, online banking frauds and others trended lower. Internet/card fraud declined 35% to Rs 71crore, indicating that the RBI’s push for banks to move from magnetic stripe to EMV chip-based cards, that are more secure, has worked in preventing frauds.

The report further showed that deposit frauds also tended lower to Rs 147 crore from Rs 457 crore a year earlier, indicating that banks are enforcing tougher KYC norms to prevent money laundering, roundtripping and other frauds.

End of Article

FOLLOW US ON SOCIAL MEDIA