Since the coronavirus outbreak (COVID-19) began in December, more than 1,400 measures have been adopted to support the financial sector by more than 140 different countries. The magnitude of this response reflects the severity of the economic damage caused by measures to halt the pandemic. The goals are to stabilize financial markets, so that credit and liquidity can keep flowing to the most affected and vulnerable sectors—especially small and medium enterprises, as well as households.

The financial sector is a key element to help countries mitigate the impact of the crisis on firms and households, and to support the recovery. Yet, a fundamental trade-off might arise between the positive countercyclical role that credit institutions are called to play now, versus their future resilience, since lenders might exhaust their existing buffers while experiencing deterioration of asset quality.

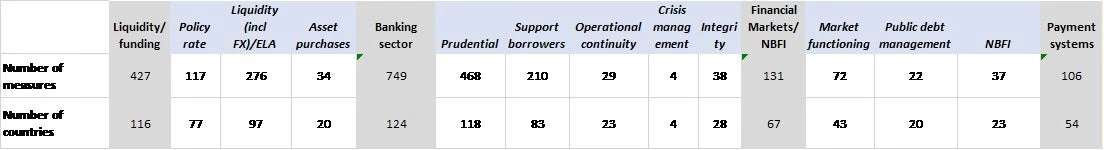

The World Bank has been tracking and analyzing the financial sector policy measures taken since late February. We have grouped them into four main categories of intervention: injecting liquidity and easing monetary conditions, supporting the banking sector and its borrowers, stabilizing financial markets and supporting Non-Bank Financial Institutions, and underpinning payments systems (see Figure 1, from our dashboard on financial sector measures).

Figure 1. Financial Sector Support Measures in Response to COVID-19

As the figure shows, most countries and regions have enacted emergency measures to provide liquidity and support financial institutions. In the early days of the crisis, a number of countries banned short selling to curtail market volatility. Confronted by massive capital outflows, several emerging markets and developing economies have intervened in foreign exchange markets and established swap lines with other central banks, mostly with the U.S. Federal Reserve. On the other hand, low-income countries, especially in sub-Saharan Africa, have approved measures targeting the payments sector, mainly to encourage the use of digital channels and mitigate the shock to remittance flows. These include waiving charges and fees and simplifying electronic Know Your Customer (eKYC) and digital identification procedures.

Overall, more than half of the 1,415 measures approved thus far target the banking sector and, within this category, almost two-thirds are prudential measures taken by regulators and supervisors to help keep lending flowing (Table 1). Over 110 countries have sought to buy time for solvent borrowers to withstand the worst effects of the supply and demand shocks induced by the lockdown.

Table 1. Measures taken by main category and subcategories of intervention (as of April 17)

This prudential line of action operates mostly through a temporary relaxation of certain key regulatory and supervisory requirements, for example on the use of buffers, reporting, or treatment of past-due loans. In most G20 economies, and some non-G20 emerging-market economies with well-developed financial markets, the package also includes clear supervisory guidance and expectations on how banks should effectively and soundly use this new flexibility. The top measures tracked in the prudential category are: credit repayment moratoria (18% of all prudential measures), supporting or facilitating the restructuring of loans (10%), relaxation in the classification and/or provisioning of non-performing assets (NPA), (7% and 6%, respectively), and releasing or deferring existing capital buffers (6%).

The use of buffers and the facilitation of loan restructuring are perfectly aligned with the existing regulatory framework. But other flexibility mechanisms, such as the use of moratoria and the flexibility in the treatment of NPA, might involve regulatory forbearance. This needs to be assessed very carefully and to be aligned with minimum prudential standards. Easing financial conditions and exercising some regulatory forbearance might be necessary as long as conditions remain difficult, though this might have important implications on financial-sector stability in the medium term. These measures need to avoid increasing financial risks, especially in those systems that are already vulnerable. Decisions should be extraordinary, time bound, transparent, and based on rigorous risk assessments. Banks should be expected to produce and disclose reliable, frequent, up-to-date, and comparable information regarding loans that have benefitted from borrower relief measures. Banks must continue to apply the relevant prudential regulatory measures in terms of classification and provisions, especially when the Net Present Value of loans changes as a result of applying relief measures. In countries with pre-existing financial vulnerabilities, including supervisory capacity constraints, reduced buffers and a poor financial safety net, the abuse of regulatory forbearance now can be especially worrying.

The full effect and duration of the COVID-19 crisis is still unknown, and its peak- and second-round effects are still to come in most countries. With indebtedness at record levels, the tight interlinkages between sovereign, financial and corporate sectors may give rise to adverse feedback loops, especially in countries with weaker crisis management and corporate insolvency frameworks. It is crucial to continue strengthening the resilience of the financial sector, while helping mitigate the impact of the crisis, so that it can play its countercyclical role now, and support the economy in the recovery phase.

Join the Conversation