Shareholder activism trends in 2019 remained largely consistent with prior years, perhaps underscoring the lasting role that shareholder activism will play in the foreseeable future. The advent of the COVID-19 pandemic ruptured existing patterns of market, investor and activist engagement that would have otherwise continued through the second quarter and second half of 2020. As of this writing, the market remains in flux as the world continues to grapple with controlling the COVID-19 pandemic and mitigating the damage it has caused. It remains to be seen how long the turmoil will last and, once it dissipates, whether business will resume where it left off, or if the COVID-19 pandemic will leave a lasting imprint on market activity, including shareholder activism, in the post-COVID-19 world.

SHAREHOLDER ACTIVISM TRENDS

Endures Before COVID-19

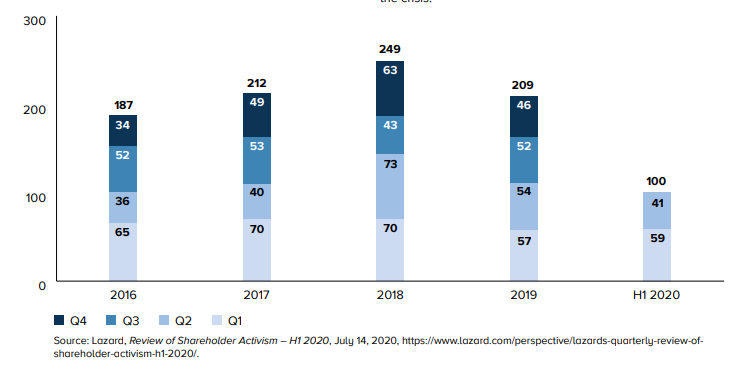

Shareholder activism has endured as a fixture of the corporate landscape. After reaching record highs in 2018, shareholder activism activity declined slightly in 2019 but remained consistent with multi-year historic averages.

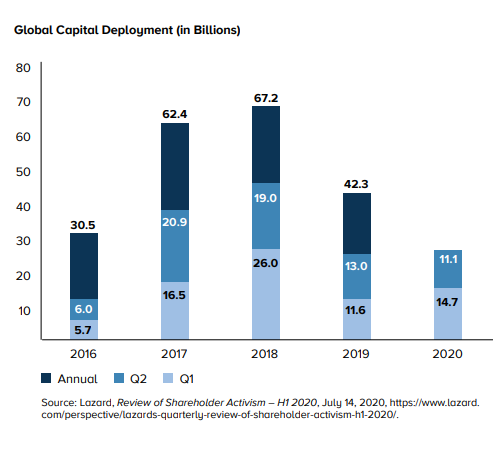

Stalls After COVID-19 Activist engagement, which typically peaks during proxy season in the first half of each year, declined in the first half of 2020 with the onset of the COVID-19 pandemic. Because activist investors typically hold their shares for some period of time after launching a proxy contest, the share sell-offs and capital outflows that accompany market volatility can inhibit shareholder activism. With director nomination deadlines for many companies falling in the first quarter of the year and annual meetings falling in the second quarter, many activists that would have spent the first half of 2020 nominating directors and launching proxy contests opted not to nominate any directors or to seek settlements on nominations they had already made. While the desire to maintain liquidity during economic uncertainty may be the primary driver for decreased activism in the first half of 2020, some activist investors may also have been concerned that campaigns initiated during the peak of the COVID-19 pandemic would be seen as “tone deaf” and detracting from the target company’s focus on priorities such as the health of their workforce and rebounding from the crisis.

ACTIVIST RANKS

ACTIVIST RANKS

Grow Before COVID-19

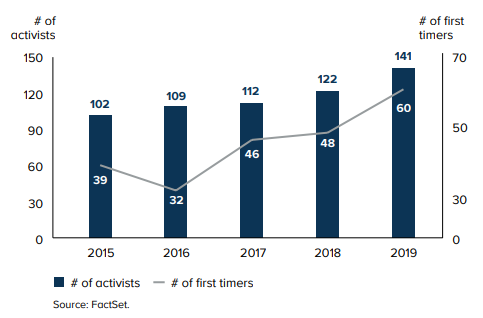

Notwithstanding fewer activist campaigns in 2019 compared to 2018, the number of activist funds continued its upward trend with a historic high of 141, of whom 60 were first time activists.

Recent campaigns by private equity firm KKR at Dave & Busters and a consortium of Elliott, MFS, Capital Group and Fidelity at CenterPoint also show the broadening of the activist investor landscape and willingness of long-term institutional investors to engage on activist campaigns.

M&A-FOCUSED ACTIVISM

Up Before COVID-19

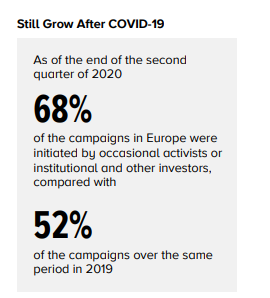

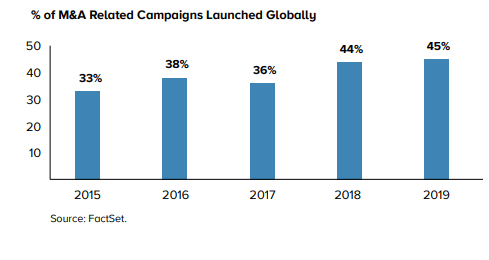

Companies are increasingly learning the lessons of prior activist campaigns and addressing vulnerabilities that activists have historically targeted, particularly relating to governance. As such, activist investors are gradually shifting their focus to M&A (e.g., agitating for a sale, opposing announced deals), with nearly half of all campaigns in 2019 involving an M&A thesis.

Down After COVID-19

Down After COVID-19

With M&A-focused campaigns steadily comprising an increasing proportion of shareholder activist campaigns and reaching an all time high of 45% of all shareholder activist campaigns in 2019, decreased M&A activity in the first half of 2020 undoubtedly put downward pressure on the number of activist campaigns. As long as M&A activity continues to be depressed, shareholder activism will likely be similarly affected.

ACTIVISTS ARE ACTIVE

While economic volatility had a chilling effect on the number of campaigns in 2020 thus far, activists have been anything but idle. Many activists have spent the last few months raising capital for new campaigns, building ownership stakes while stock prices were low and preparing to launch new campaigns in the latter half of 2020. Nevertheless, increased capital outflows, particularly following the stock market dip in March 2020, put pressure on smaller firms that may have been less diversified and well-capitalized than their more established peers.

POISON PILLS CAME BACK

POISON PILLS CAME BACK

When stock markets plunged in March 2020 following the global shut-down amid the growing COVID-19 pandemic, companies began adopting defensive postures to preempt shareholder activism and implementing shareholder rights plans at rates not seen in a long time. Many of these plans have notably been adopted by companies in the absence of a specific takeover or activist threat. But as markets slowly recovered in April through the time of this writing, poison pill adoptions have tapered off. As the COVID-19 pandemic evolves and markets respond, it remains to be seen whether another market downturn will again trigger a new wave of poison pill adoptions. While proxy advisors such as ISS and Glass Lewis have historically been wary of shareholder rights plans, they acknowledged that the COVID-19 pandemic has created a “reasonable context” for adopting a poison pill that has acceptable features and meets certain conditions.

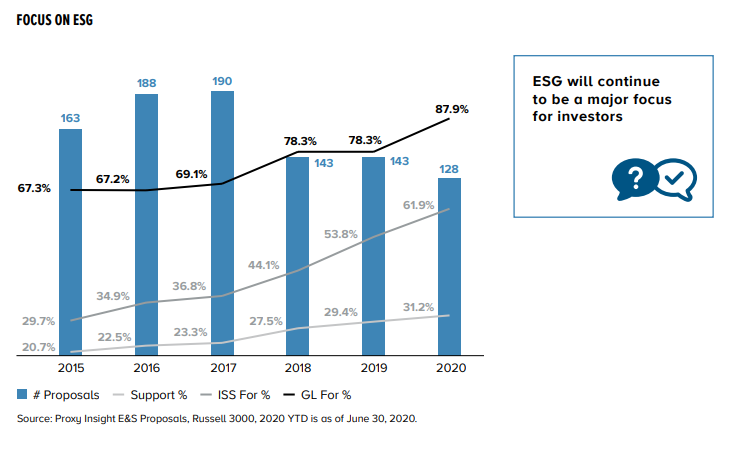

The increased focus on ESG from institutional investors, proxy advisors and other corporate constituents continued through 2019. Not only were institutional investors like BlackRock, Vanguard and State Street more publicly vocal about the importance they are placing on ESG-related matters, but they also signaled an increased willingness to encourage and support ESG-driven activist campaigns.

While environmental and social matters have lagged somewhat behind governance as a focus of activist campaigns, support for environmental and social shareholder proposals has climbed steadily. For Russell 3000 companies, for example, each year, including 2020, has brought new alltime-high support for Environmental and Social (E&S) proposals, indicating that activists are not only more willing to pressure corporate boards on ESG matters, but they are also able to garner more support than ever from other shareholders on their ESG-related campaigns. The number of shareholder resolutions proposed in the first half of 2020 is significantly lower compared to the same period in prior years, but interestingly, as of June 30, 2020, the number of E&S-related shareholder resolutions remained on par for the same period in 2019. In the short-term, ESG-related activism will likely see the same decline as other activist campaigns have experienced since the onset of the COVID-19 pandemic. ISS/Glass Lewis, who have been among the strongest advocates for ESG matters, acknowledged that these issues may be subject to “shifting timeframes and priorities,” given the immediate concerns created by the crisis.

While the COVID-19 pandemic may have had a chilling effect on the initiation of new activist campaigns, it may ultimately heighten the focus on ESG. As the temporary slowdown in activist campaigns ends, investors and the other corporate constituents may press companies to explain the actions they took (or did not take) as the crisis unfolded, especially as it relates to managing their workforce and executive compensation. If the crisis exposes governance shortcomings, then activists may want to push forward replacements who they believe would be better managers and would mitigate risks relating to executive succession and diversity (or lack thereof).

Although ISS/Glass Lewis have acknowledged that ESG actions may be delayed and that corporations may need to adopt defensive measures like poison pills during the crisis, they have also insisted that ESG is as important as ever as companies navigate the “new normal” created by the COVID-19 pandemic. Expected areas of heightened focus include human capital management (“with widespread layoffs, varied treatment of employees, concerns regarding quality healthcare and the failure to provide safe working environments at many companies, this shareholder concern is likely to have a breakout moment in shareholder proposals next year,” predicts Glass Lewis)2, racial and gender diversity, climate change and risk management.

The COVID-19 pandemic may have temporarily quieted new activist campaigns, but the conditions that forced the slowdown will soon dissipate. That some activist firms spent the first half of 2020 buying stock at low prices suggests that certain well-capitalized firms are spending their time in quarantine preparing to restart their campaigns. So while companies may have enjoyed a temporary reprieve from shareholder activism, those that fail to proactively and effectively address the issues brought to the fore by the COVID-19 pandemic do so at their peril. When activist campaigns resume, companies may find themselves more vulnerable than they were before the COVID-19 pandemic, and with activist ranks continuing to grow, a broader and more powerful base of shareholders may be in the wings waiting for activist engagement to resume.