— “Too many of these companies pick the last dollar out of consumers’ pockets — and far from leaving them better off, push them deeper into debt, even bankruptcy.” — former Federal Trade Commission Chairman Jon Leibowitz, July 29, 2010.

— “With the average American carrying thousands of dollars in credit card debt, debt settlement services can seem very appealing. But far too many of these businesses fail to deliver on their promises and leave consumers in a worse financial situation.” — Ohio Attorney General Mike DeWine, March 12, 2012.

Slithering through the Ohio Legislature, not drawing a word of news coverage, is a bill that would plop down a Buckeye State welcome mat to an industry riddled with quick-buck artists.

So-called “debt settlement” companies are among the many would-be saviors to people drowning in credit card debt. In this system, clients are typically told to stop making debt payments, but to build up sums of money in escrow that the companies can dangle to creditors in return for a lower payoff amount. Only after they succeed are they supposed to charge fees.

But abuses soared in the late 2000s during the Great Recession. The U.S. General Accounting Office identified allegations involving “hundreds of thousands” of consumers nationwide complaining of “fraudulent, abusive or deceptive practices.” The FTC banned debt settlers from charging up-front fees in 2010. By 2013, more than half the states had curbed the fees of companies hired to help dissipate debt.

Ohio was far ahead of the pack. In 2004, its Republican-controlled legislature and Republican Gov. Bob Taft enacted fee caps on companies that help people “effect the adjustment, compromise or discharge” of their debts. One limits “consultation fees or contributions” to $100 a year. Another caps debt-management or similar plan fees to 8.5 percent of a person’s monthly debt payments, or $30, whichever is greater.

But the debt settlement industry, led by its American Fair Credit Council trade group, has been ramping up its lobbying effort to repeal the fee caps. It has not just a couple, but eight registered lobbyists working on its behalf in the Ohio Legislature.

House Bill 182 and its twin Senate Bill 120 would give the industry what it wants. As long as debt-relief companies comply with federal law, they would be completely immunized against Ohio’s 2004 fee caps.

What lawmakers determined that Ohioans need greater access to debt-relief hucksters that can charge whatever they want?

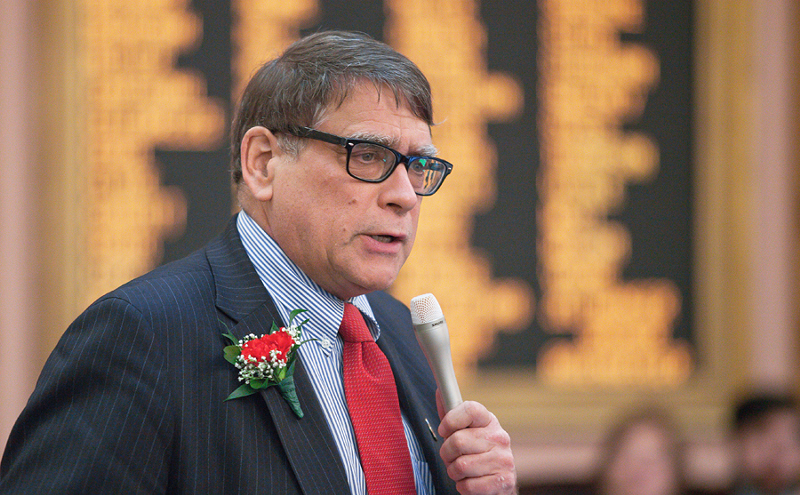

In the House, that would be Bill Seitz, R-Green Township. He introduced the same bill as a senator in 2015, but his colleagues took a pass. The AFCC was thankful, though, and made Seitz its keynote speaker at a conference the following April — in New Orleans. The two-day affair took place at the Ritz Carlton Hotel in the French Quarter. The AFCC picked up Seitz’s $929 travel and lodging tab.

The 2017 edition of the bill is making most headway in the Senate, where another Green Township Republican, Lou Terhar, is the lone co-signer to bill sponsor John Eklund of northeast Ohio. The Senate Insurance and Financial Institutions Committee has held three hearings, but hasn’t scheduled a vote.

CityBeat asked Seitz and Terhar why they would eliminate the state’s debt-relief fee caps. Terhar never responded. Seitz, by email, took the position that the Ohio Debt Adjuster Act and, thus, the fee caps, don’t apply to debt settlement companies.

That’s contrary to previous interpretations. The Ohio Legislative Service Commission, which analyzes all bills, reviewed a similar industry-friendly House bill pushed out in 2013 by Terhar and Dale Mallory, a Cincinnati Democrat no longer in office. It wrote that debt settlement services likely fall under the definition of “debt adjusting” and are subject to Ohio’s fee caps.

Ohio courts case law also contradicts Seitz's position.

In a 2012 lawsuit against California debt settler Jeremy Nelson, Attorney General DeWine cited the Ohio Debt Adjuster Act when he accused Nelson of charging fees higher than the law allowed. Franklin County Common Pleas Judge Colleen O’Donnell ruled in the state’s favor in 2014. In her 11-page order, she found that Nelson met the definition of a “debt adjuster” and violated the statute.

Colorado restored fee caps

The absence of news coverage of the Ohio bills belies the notoriety of the debt settlement industry. The U.S. Justice Department has cracked down on rogue players. The Consumer Federation of America likens the hiring of debt settlers to playing the lottery. The U.S. Consumer Financial Protection Bureau says debt settlement can leave people deeper in debt than they were. The Center for Responsible Lending says fees can be high, even when all or most of the debt isn’t negotiated away.

Pamela Maggied, a Columbus bankruptcy lawyer, testified against Senate Bill 120 on Oct. 3.

“These harassed and desperate people are not always able to separate the unscrupulous and the greedy from the legitimate,” she said. “They frequently don’t think they have time to shop around and investigate and evaluate alternatives; they just grab the closest rope.

“Lifting the state limits on fees that can be charged by debt adjusters may just make their plight worse,” Maggied said. “It could make Ohio be a better place for an unscrupulous debt adjustment company to ply its trade, and put more desperate Ohioans into a financial dead-end.”

In 2011, Colorado did what Seitz and Terhar are asking the Ohio Legislature to do today: It did away with its fee caps, which had been set at 18 percent of the total debt owed. After the repeal, fees rose to as high as 25 percent, the state observed. Now, under a new law, “debt-management” companies must comply with rigorous standards on registration, disclosures, business practices and fees.

“The data from Colorado showed more than half the consumers who entered the program did not complete it — and terminated within two years,” said Kalitha Williams, of the liberal thinktank Policy Matters Ohio, before the Senate Insurance and Financial Institutions Committee on Oct. 3.

The most common ways of dealing with overwhelming credit card debt are hiring a consumer counseling firm, which are typically nonprofit, and filing bankruptcy. Consumer counselors’ fees are subject to the state fee caps. Lori Pollack, executive director of the Financial Counseling Association of America, says fees are routinely waived or reduced for distressed clients.

‘Poverty profiteers’

Randy Williams, president of A Debt Coach in Florence, Ky., is one of those credit counselors. He was stupefied by the measure to open the floodgates to debt-relief companies by eliminating fee caps. The biggest companies, he says, honor the rules and provide a legitimate service. The rest he considers “fly-by-night.”

Williams offers his take on the debt-settlement method in a video on his website. Removing the cap on fees, he says, would be like releasing a lion on a flock of sheep.

“I find it interesting that people’s elected representatives are trying to change law to hurt the people they represent,” Williams says. “I guarantee you nobody ran for office on this platform. West Side people need to know what’s going on.”

Dr. Troy Jackson, director of The AMOS Project, a nonprofit social justice group in Walnut hills, praises Seitz’s work on mass incarceration, but says his bill for the debt settlement industry is misguided.

“At a time when our nation is calling for protections for consumers who are suffering from poverty profiteers, Rep. Seitz has the audacity to go to bat for those profiting off the poor,” Jackson says.

“Far too many in Cincinnati, in Ohio and around the United States find themselves in a perpetual spiral of greater debt and higher interest, calling to mind the days of sharecropping and company stores,” he says. “When it comes to his defense of poverty profiteers, Rep. Seitz is on the wrong side of justice, the wrong side of his district and the wrong side of history.”

CONTACT JAMES McNAIR at [email protected], 513-914-2736 or @jmacnews on Twitter