The federal government has privately admitted it will be forced to refund more than 400,000 welfare debts worth about $550m that were wrongly issued to hundreds of thousands of Australians under the botched robodebt scheme.

Confidential government advice seen by the Guardian reveals for the first time the scope, size and impact on the vulnerable of the years-long robodebt debacle, including that the government expects to lose an upcoming class action against the income compliance program and intends to settle.

It can also be revealed that despite government assurances that all Centrelink resources have been diverted into processing a growing backlog of new dole claims thanks to the coronavirus crisis, Services Australia staff continue to chase Australians for payslips and bank statements in an effort to validate potentially unlawful welfare debts.

Facing a class action from Gordon Legal and calls from Labor and the Greens to immediately refund debts calculated using the unlawful “income averaging” method, the government has publicly declined to detail its next course of action, saying only that it has refined the program in response to “feedback”.

But a leaked ministerial submission to cabinet from government ministers Stuart Robert, Anne Ruston and Christian Porter, prepared last month, reveals the commonwealth expects to refund more than 400,000 debts over the next 12 months.

“Services Australia estimates that it will administer 449,500 refunds determined under the programme, and their associated repaid debts would be refunded commencing in July 2020 and concluding within 12 months,” it says.

The submission says Services Australia estimates that “$555.6m in cash payments have been received from recipients to date for those in-scope debts”.

About 80,000 debts would be reassessed before “refunding or reaffirming the debt”, the submission says.

It is understood that the expenditure review committee of cabinet agreed last month to instruct the commonwealth’s legal representatives to begin settlement negotiations on the basis that it is prepared to refund invalidly raised debts.

But they were also instructed to first oppose paying interest on the debt refunds, demand Gordon Legal withdraw its negligence claims, and would reconsider if the proposal was unsuccessful.

Before the Covid-19 pandemic began, the parties were headed for mediation before a court hearing expected in July. It is unclear what impact the coronavirus crisis will have on this, or the government’s plans.

A spokesman for Robert told the Guardian: “Aspects of the Income Compliance Programme are currently before the federal court.

“As such, it would be inappropriate to comment while these matters are under active consideration.”

The government has overhauled the welfare system and doubled unemployment benefits to support an estimated 1 million additional jobseeker payment recipients as a result of job losses caused by the coronavirus shutdown.

Robert, the government services minister, and Ruston, the social services minister, have been under pressure to address capacity issues at Centrelink after the agency failed to cope with unprecedented demand from Monday.

On Monday night, Ruston told the Senate “over the last few days every resource that has been available within Centrelink and all external resources that we have been able to access have been moved into the processing of the new payments”.

But two people have told the Guardian they faced demands from Centrelink’s compliance division last week for financial information to finalise old alleged overpayments.

A third person told the Guardian on Thursday they had been contacted by Services Australia staff on Tuesday asking for old payslips or bank statements to finalise a debt review.

The Melbourne woman, who did not want to be named to avoid prejudicing her welfare application made this month, said she received a text message saying she would get a call from Centrelink on a private number.

“I thought it was about my pending Austudy claim or my partner’s pending Newstart claim,” she said.

Instead, she was asked to provide bank statements from 2014 over a potential overpayment of $12,000.

“I was so surprised they’re bothering chasing that up now, with the literal collapse of their system from the amount of people who need help,” the woman said.

“And I challenged the person on the phone so [they] said they’re doing a big overhaul of the system and chasing up these outstanding issues.”

Although the leaked ministerial submission from Robert, Ruston and Porter says the government should abandon the robodebt scheme, it is understood that last month the decision was deferred until the federal budget, which has now been pushed back to October.

The two options put forward were continuing the program through legislation to ensure its legality, or scrapping it, which would cost the budget $700m to 2023-24.

Under the robodebt scheme, welfare debts sometimes in excess of $10,000 were raised against the unemployed and students, as well as particularly vulnerable groups such as disability pensioners, while tens of thousands of people also had their tax refunds garnisheed.

The government has not launched any new income compliance debt reviews since December after it conceded a federal challenge to the scheme in November.

Labor’s government services spokesman, Bill Shorten, said the government needed to “come clean with the public”.

Noting Robert’s claim that changes to the program were only a “refinement”, Shorten added: “And now we know he admits in private more than 400,000 debts worth $550m will have to be repaid.”

“The government must repay robodebt victims the interest they are owed as well as the money unjustly taken from them.”

The Greens senator Rachel Siewert said: “This program has literally cost people’s lives, ruined many many more and caused so much pain and anguish.

“I am pleased that it looks like the government will have to compensate victims of the illegal Robodebt scheme but nothing can truly compensate people for the distress this has caused.”

In its defence to the class action, the commonwealth rejected Gordon Legal’s arguments of negligence and the claim that the government holds a common law duty of care to social security recipients.

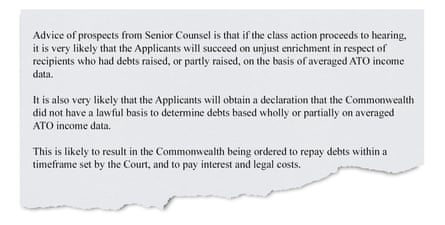

It is understood the government’s legal advice is that the class action’s claim for negligence is unlikely to succeed, but that applicants are likely to be successful in their claims for unjust enrichment and for interest on refunds.

About 18,000 recipients who consented to the use of “income averaging” to calculate their debt are also proposed to receive refunds “on the basis of legal advice”, the leaked ministerial submission says.

Under the process favoured by the government, potential robodebt victims would be expected to self-identify.

The ministerial submission says the government will prevent future debts through the implementation of its Single Touch Payroll plan, which passed parliament earlier this year.

But that plan will not begin in July as planned, due to the coronavirus pandemic.

Ruston was also approached for comment.

Do you know more? luke.henriques-gomes@theguardian.com