What Are The CRE Debt Instruments?

Real Estate Bonds and Securitized Real Estate Assets

Real estate bonds are fixed-income capital market instruments that are secured by income-producing property (IPP). They come in the form of a property or mortgage bond.

Property bonds are generally high-yield intermediate-term bonds issued by property developers and construction companies to fund property development projects during their construction phase. Mortgage bonds are long-term corporate bonds secured by the pledge of specific commercial real estate owned by the issuer, such as land and buildings.

A covered bond is a generally fixed-rate capital market debt instrument secured by both the issuer's creditworthiness and a high-quality collateral pool, mostly high-grade mortgages or loans to the public sector. They are issued directly by a financial institution that is liable for the security's repayment and backed by the special pool of collateral.

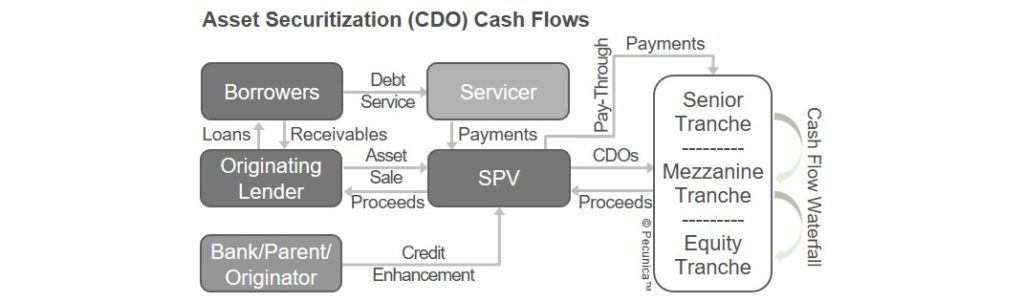

A mortgage-backed security (MBS) is a securitized debt obligation that represents a claim to the cash flows from mortgage loans that are grouped into a single pool that serves as collateral for the securities. As a pass-through security, the payments of interest and principal received by the issuing SPV on the pooled assets are passed to the investors in equal measure in the same period received net of service fees, with every investor having equal rights over the cash flows.

Large commercial properties may be financed by commercial mortgage-backed securities (CMBS) in the form of a collateral mortgage obligation (CMO). As a pay-through security, the payments received by the SPV on the pooled loans are first used for payment to the senior tranches and then paid to more junior tranches only when the priority claims of the senior creditors are fully satisfied (the "cashflow waterfall").

The commercial mortgage-backed securities (CMBS) market, a major source of capital for many hotel owners. Out of the $300 billion in CMBS loans in the US, hotels comprise $86 billion in debt in 2019.

Syndicated and Club CRE Lending

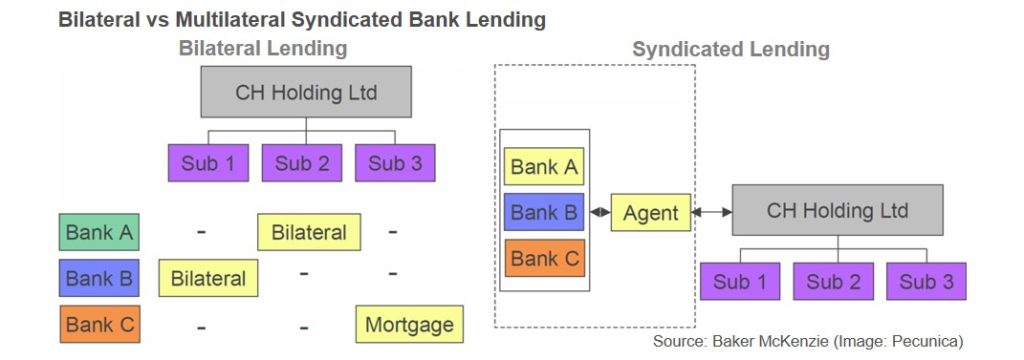

Syndicated lending is multilateral lending that is originated, arranged and structured by one or more commercial or investment banks and marketed to a group ("syndicate") of underwriters and/or lenders. Syndicated facilities are marketed to other banks and investment entities on the borrower's behalf with the objective of securing their commitment to provide the required financing.

A syndicated facility is financing in which a revolving credit and/or term loan facility is arranged and provided through direct syndication and/or funded participation by more than one lender on uniform terms and conditions using common documentation. Syndicated loans are administered by a common party - usually the loan originator and lead arranger.

When the amount of financing required by a borrower is too large for a relationship bank to provide on its own, a club deal may be arranged. In a club deal, a group of banks underwrites the full amount of a multilateral loan at the outset of the transaction with no intention to subsequently reduce their investment in the loan ("final hold"). The club deal syndicate is closed when the facility agreements are executed (signed), without general syndication and without subsequently trading the loan in the secondary market.

Syndicated real estate lending finances new property investment/acquisition, the refinancing of existing facilities, property development as well as unsecured real estate lending and distressed refinancing. Commercial and investment banks account for the majority of the participation in syndicated real estate financing, followed by private equity and debt funds, insurers and pension funds, and building societies.

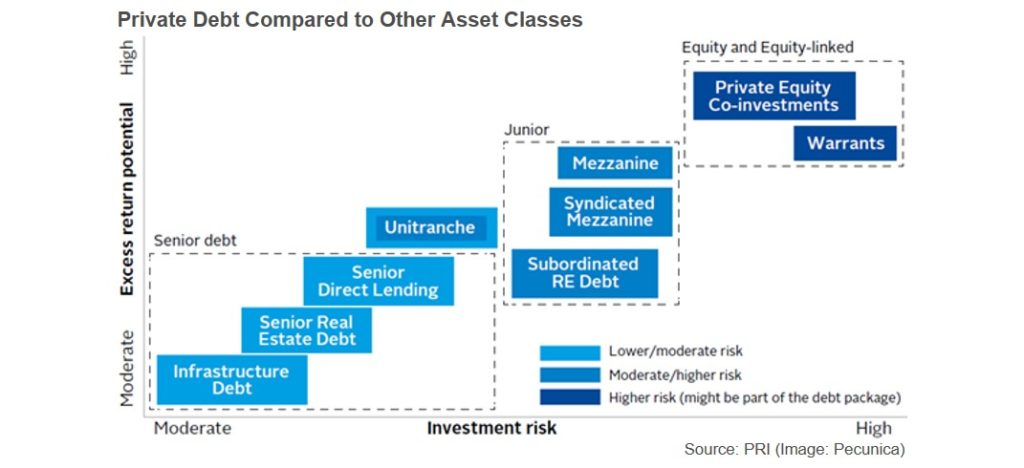

Funds are prevalent in the leveraged loan, real estate and infrastructure debt markets. Hedge funds, CLO/CDO and distressed debt funds provide mezzanine and subordinated debt in acquisition and real estate development and investment transactions frequently as loan-to-own investments. Alternative credit investors, such as direct lending funds, provide debt in the mid-market.

Private Debt Funds and Debt REITs

A private debt fund is a direct lending fund, commonly in the form of a closed-end investment company, generally only for the investing of institutional investors and high-net-worth individuals (HNWI). Individuals usually provide private debt via crowdlending platforms and investing in debt mutual funds, which also lend to property companies.

Private debt funds are commonly used for direct lending for real estate construction and property acquisition. Property developers also often lend against the projects of other developers since they have experience in such financing.

The mortgages against the properties serve as the security for lenders in private debt funds, which entitle the fund to take control of the underlying property in the event of default on their loans. Interest payments are the primary source of return on their investments.

A real estate investment trust (REIT) is a corporation, trust or association that finances, owns and typically operates income-producing property or related assets for its investors. REITs issue transferrable certificates that evidence ownership, a creditor position, or both in the form of an equity REIT, a debt REIT, or a hybrid REIT, respectively.

Debt REITs lend money to real estate developers, sponsors and buyers in the form of debt or debt-like instruments, including first mortgages, mezzanine loans, and preferred equity. Debt REITs generate revenue from the interest earned on the debt.

A mortgage REIT evidences a creditor position in mortgage loans either made directly to real estate buyers, developers and sponsors or to invest in outstanding mortgage loans or mortgage-backed securities (MBS). It generates revenue mainly from the net interest margin on the investments - the spread between the interest received and the cost of funding the loans.

For tax exemption, REITs are commonly required to distribute at least 90% of their annual taxable income to their shareholders. This applies to US REITs and REITs in most European countries.

Copyright © 2020 Pecunica LLC. All rights reserved.