Student debt cancellation already in focus amid President-elect Biden transition

President-elect Joe Biden made a campaign proposal to erase $10,000 for roughly 37 million Americans who owe federally-backed student loan debt, and experts are divided on whether the incoming president will be able to make good on that promise.

“To just wipe out student debt… that was one of the further left ideas that is not going to be feasible given that the Republicans really fought the Democrats to draw” in Congress, Michael Petrilli, president of the think tank Thomas B. Fordham Institute, told Yahoo Finance.

There are two routes that could cancel student debt in theory: Either through legislation or through an executive action.

In practice, student loan forgiveness could be either included as part of a new stimulus package passed by Congress or enacted by a President Biden asking his secretary of education to cancel debt.

“We’re committed to fighting to ensure that student debt relief is included in any future stimulus deal,” Natalia Abrams, executive director and co-founder of Student Debt Crisis, said.

The executive order route is premised on the Higher Education Act, which provides broad authority to the president (through the education secretary) to cancel debt.

“I have a proposal with Elizabeth Warren that the first $50,000 of debt be vanquished,” Senate Minority Leader Chuck Schumer (D-NY) asserted recently, “and we believe that Joe Biden can do that with the pen as opposed to legislation.”

The Biden administration would “have the power and legal authority to order their Department of Education to cancel millions in student debts on day one of their administration,” Project on Predatory Lending Legal Director Eileen Connor stated.

1. Biden-Harris can cancel billions of dollars in student loan debt, giving tens of millions of Americans an immediate financial boost and helping to close the racial wealth gap. This is the single most effective executive action available for a massive economic stimulus.

— Elizabeth Warren (@SenWarren) November 12, 2020

‘Cancellation won't necessarily happen overnight’

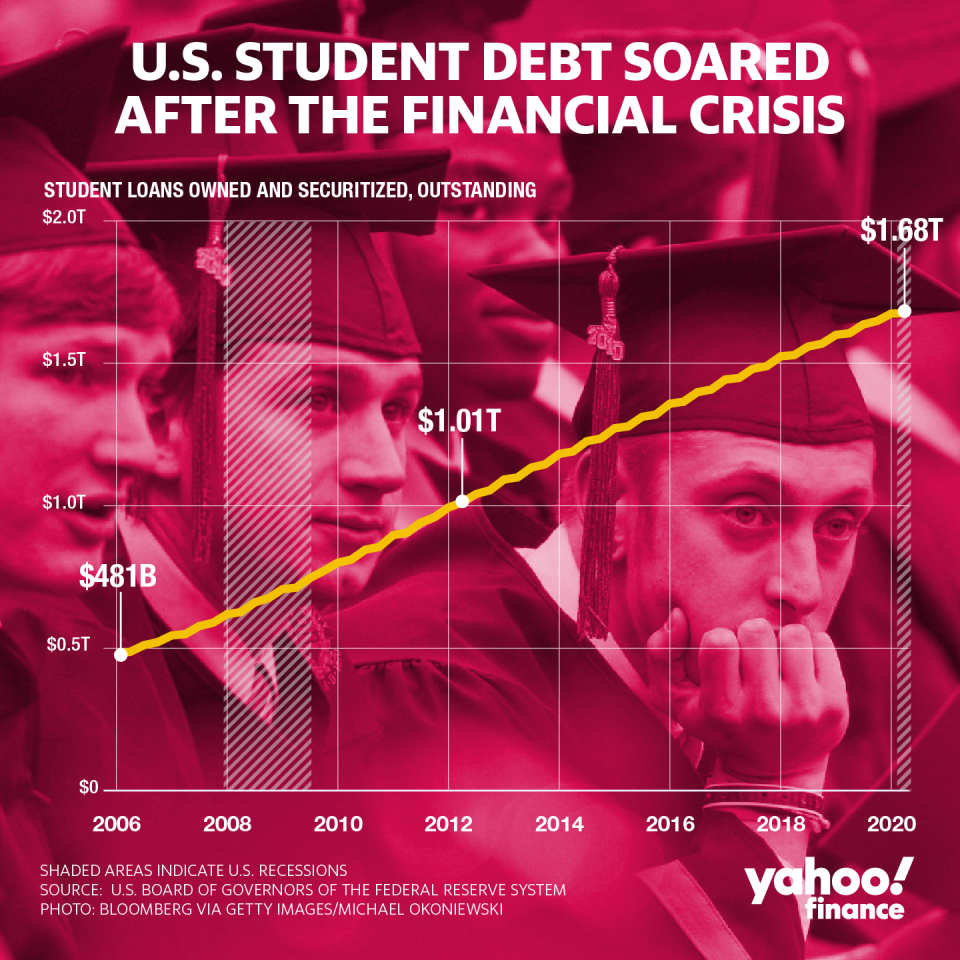

Outstanding student loan debt in the U.S. is nearing $1.7 trillion, according to the New York Fed.

“This is something that has been crushing the hopes and dreams of too many Americans for far too long,” former presidential candidate Andrew Yang stressed on Yahoo Finance Live (video above). “I met people on the [campaign] trail who were in their 50s and 60s and still struggling with some of the $1.6 trillion in student loan debt.”

Around 7% of that debt was in serious delinquency as of July 2020. Amid the coronavirus pandemic, the federal government’s payment pause on federal loans has helped many borrowers avoid delinquency.

Whether Biden’s team would pursue the executive argument is unclear, and experts are cautious about the idea that debt cancellation would happen anytime soon.

“Cancellation won't necessarily happen overnight,” Ashley Harrington, federal advocacy director at the Center for Responsible Lending told Yahoo Finance, adding that the process included taking the initial steps to understand what legal arguments to put forth and coordinating with agencies like the Internal Revenue Service (IRS) to make sure the debt isn’t taxable.

At the same time, the National Student Defense Network noted that the secretary of education can quickly take “administrative actions” enshrined in the Higher Education Act to cancel borrowers’ student loans.

The Project on Predatory Lending argued that an executive order could be a real fix for Obama-era borrower defense regulations protecting defrauded borrowers, which the Trump administration attempted to dismantle despite court rulings favoring borrowers.

‘Economic activity would in turn be boosted’

Canceling debt could have ripple effects, experts stated previously.

One report by Moody’s Investors Service said that forgiving student loans could stimulate the economy in the near term by serving as a “tax-cut-like stimulus.”

“A partial or total student debt cancellation would increase households' disposable income by the amount of debt service saved,” the report stated. “Economic activity would in turn be boosted by the portion of these debt service savings channeled into other current and investment spending. At the same time, some households could potentially increase spending beyond their debt service savings if their improved net financial wealth entices them to save less and spend more overall, yielding even greater stimulus to the economy.”

And since more than 90% of student debt is in the hands of the U.S. government, the report noted, forgiving that debt isn’t all that different from slashing taxes to the government.

A separate report by the Levy Economics Institute of Bard College added that debt cancellation “could boost real GDP by an average of $86 billion to $108 billion per year” and reduce unemployment.

And aside from boosting economic growth, forgiveness also frees Americans from debt, allowing them to increase spending, improve their credit scores, and spend more on consumer goods.

“Cancellation will disproportionately impact Black and Brown borrowers, low income borrowers, and female borrowers,” Harrington noted, stressing that this is especially true for Black borrowers “because of the history of discriminatory policies … in the financial marketplace that continue to this day.”

This post has been updated with a tweet by Senator Elizabeth Warren.

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

Election 2020 'has enormous implications for student loan debt'

New Jersey AG files suit accusing student loan giant Navient of 'unconscionable' practices

Warren and Schumer urge student debt cancellation of up to $50,000 for all federal borrowers

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance