Wonga boss answers Newsbeat listeners' questions

- Published

Payday loan companies are facing a group of MPs after criticism of their business practices.

The organisations, including Wonga, QuickQuid and Mr Lender, are defending themselves against claims their loans make it easy to run up debts.

The Office of Fair Trading (OFT) is also investigating these companies.

There are worries payday loans can prevent users getting credit in the future and people are rolling loans over and borrowing more.

One of the country's best-known mortgage commentators, Ray Boulger from the advisers John Charcol, told Newsnight that taking out a payday loan could adversely affect any future mortgage offer:

"Our experience is that mortgage lenders will often turn down requests for people who have had a payday loan - the regulator should require payday lenders to display this."

However, many people use pay day loans without problems.

There are no official figures on how many people use this sort of borrowing.

The OFT thinks that as much as £1.8bn a year may now be being lent by payday lenders.

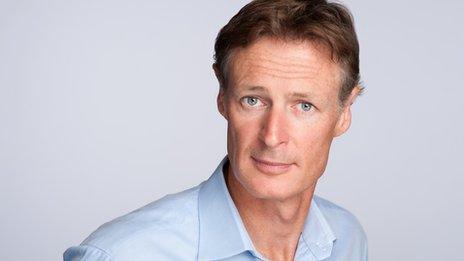

Newsbeat has interviewed Wonga's chief operating officer, Niall Wass, and asked him some questions from listeners.

Luke from Prestatyn asked: "How can Wonga get away with stalking you? If I was to ring you up every day, you'd get a restraining order."

Niall Wass said: "What is it exactly that we're getting away with? The average loan is £180 for 17 days. People pay £36 in interest and fees on that.

"It's very clear and transparent and if you don't pay back then you will get charged a default fee and we'll contact you to say, 'Hey, have you got an issue?'

"If we're bombarding, we shouldn't be doing that. I'll definitely look into that.

"We do send a text and an email before just to remind people they promised to pay us on a certain date and if they don't then we also remind them that they've missed that payment and we want to know if we can help them in some way to stand up to their commitment."

Beth from Doncaster asked: "How do you feel when a woman takes out a £300 payday loan with Wonga, lies by saying she is working and is now complaining because she owes £2,000?"

Niall Wass said: "We have to be responsible and do whatever we can to make sure people can do two things, they can afford to pay us back and they have the intent to pay us back.

"Obviously if people are lying to us, that makes our job pretty difficult so we ask that people on the other side treat this responsibly as well.

"The vast majority of people tell the truth and even if they don't, we use 8,000 pieces of data to check every single application so it's very, very hard to do.

"We turn down eight out of 10 of the first time borrowers so we're very, very cautious about who we lend to.

"The vast majority of our customers pay back on time. Less then seven percent of people don't."

Denver from Kent asked: "Will you put notices up in branches warning people that taking up a Wonga loan will seriously harm your chances of getting a mortgage?"

Niall Wass said: "We don't particularly worry about that because it's something that we don't come across regularly.

"In fact, when we talk to the two biggest credit agencies in the UK, they don't tell us that's a particular issue."

Follow @BBCNewsbeat on Twitter

- Published3 December 2013

- Published26 July 2013

- Published25 November 2013

- Published28 May 2013

- Published8 May 2013