Posthaste: Canadians' concerns about their finances hit pandemic high — yet low rates are driving them to take on more debt

Many could be in for 'painful debt reckoning'

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

Good Morning!

At no point in this pandemic that has turned lives upside-down have Canadians been as concerned about their finances as they are now, a survey has revealed.

The MNP Consumer Debt Index, released today, plunged to it lowest since it started in 2017, dropping 5 points since September in the largest quarterly decline ever.

The survey is conducted quarterly by Ipsos for insolvency trustees MNP to track Canadians’ attitudes about their debt situation and their ability to meet monthly payments.

The lower the reading, the more pessimistic Canadians are feeling and this poll, taken in December, found that negative perceptions about personal finances and household debt are rising, along with concerns about weathering setbacks.

“Almost one year into the coronavirus crisis, the financial confidence of Canadians has reached a low point. The virus has understandably created significantly more financial anxiety for those directly impacted by job loss, declining wages and business closures. The Index shows that financial pressure is mounting for a large proportion of the country,” says MNP president Grant Bazian.

Four in 10 (43%) Canadians say they are not confident they can cover their living expenses for the next year without going further into debt, an increase of four points from September.

“When we see so many Canadians feeling like they can’t afford living expenses without taking on more debt, it signals that more financial upheaval is on the horizon – particularly with so much uncertainty still ahead,” said Bazian.

More (42%) are concerned about their current level of debt and 45% regret the amount of debt they have taken on. Just one in four respondents feel confident in their ability to cope with loss of employment or change in wages.

Yet the survey also found that about three in 10 Canadians (28%) have taken on more debt as a direct result of the pandemic.

And perhaps most worrying, 61% of respondents thought with interest rates low now is a good time to buy things that they otherwise might not be able to afford.

In Ontario those numbers are even higher (63%), a sign that Ontarians could be setting themselves up for a “painful debt reckoning,” said MNP.

Three in 10 Ontarians (29%) say they’ve taken on more debt as a direct result of the pandemic, with the biggest percentage, 17%, saying it was on credit cards.

“Those who are already cash-strapped, saddled with debt, and struggling to navigate risk being lulled into a debt trap,” said Caryl Newbery-Mitchell, an insolvency trustee with MNP in Toronto. “The results can be disastrous when individuals in financial trouble try to cope by taking on additional debt. It’s like trying to fill one hole by digging another.”

Respondents were worried about this as well. Almost half (47%) said they were afraid that if interest rates go up they could land in financial trouble. About a quarter said their debt was keeping them awake at night, up 3 points since June.

_____________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

FIN-TOK: Bianca Bharti scrolls through endless videos of awkward dance moves and bad lip-syncing to reveal How Gen Z and millennials are finding personal finance salvation in an unexpected place — 60-second clips on TikTok.

- U.S. Markets are closed today for Martin Luther King Jr. Day

- Petronas International Energy Speaker Series on Canada’s Successful Path to 2050 sponsored by the Haskayne School of Business. The online event focuses on exploring Canada’s role in serving the world’s energy needs for the next 30 years from diverse

perspectives. With Tengku Muhammad Taufik, Group CEO of Petronas Global and Seamus O’Regan, Minister of Natural Resources - The Association for Mineral Exploration presents Remote Roundup 2021, the virtual debut of the annual AME Roundup conference

- A panel comprising experts and current and former senators and will discuss ways to move forward with economic recovery for all in Ottawa

- Today’s data: Canadian housing starts

___________________________________________________

_______________________________________________________

- Joe Biden planning to cancel Keystone XL permit on Day 1: transition documents

- Kenney, Moe condemn Biden’s plan to scrap Keystone XL on Day 1 of presidency

- Canada’s Couche-Tard drops $20 billion Carrefour takeover plan, after opposition from France govt.

- Couche-Tard to explore partnership opportunities with Carrefour, after takeover plan fails

- China’s economy picks up speed in Q4, ends 2020 in solid shape after COVID-19 shock

- BlackBerry CEO John Chen gets $128-million award to stay on for at least 5 more years

- In mandate letter, Trudeau tells Chrystia Freeland to use ‘fiscal firepower’ on temporary measures until crisis ends

- This Ontario couple needs to get their debt under control to enjoy a carefree retirement

- New data from CRA shows Canadians have nearly 300 billion reasons to love their TFSAs

- ‘It’s a critical situation:’ Dragon’s Den star Arlene Dickinson on struggle of small business to survive the second lockdown

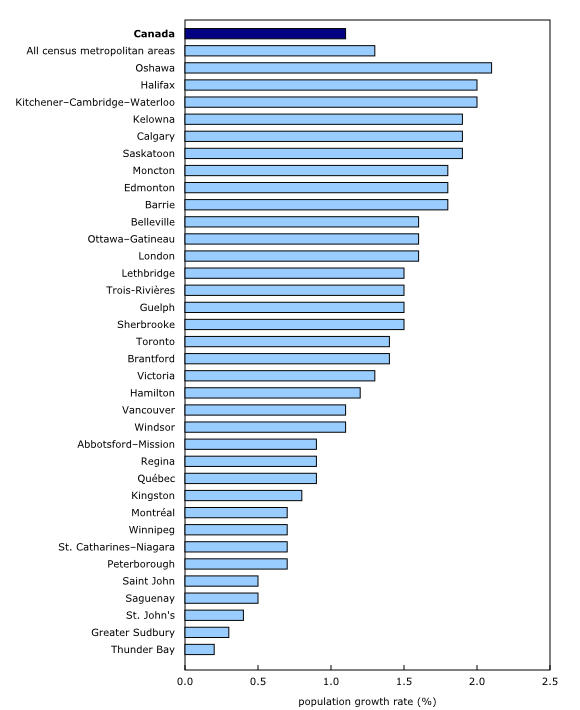

More people are opting to live outside of Canada’s largest urban centres, which is contributing to ongoing urban sprawl, according to Statistics Canada.

“Despite still showing overall positive population growth, mostly due to international migration, the census metropolitan areas (CMAs) of Toronto, Montréal and Vancouver continued to see more people moving out to other regions of their province rather than moving in,” the statistical agency noted.

Toronto lost more than 50,000 people and Montréal just under 25,000 due to an exodus to nearby regions by July 2020 compared to a year ago.

“In Toronto, the net loss was mainly driven by people moving to surrounding CMAs. For example, the population growth in Oshawa (+2.1 per cent) — which posted the fastest growth—was partly due to migration flows from the neighbouring CMA of Toronto,” StatsCan said in a report last week.

Meanwhile, cities such as Farnham (+5.2 per cent) and Saint-Hippolyte (+4.1 per cent) saw an influx of people, partly from Montreal.

____________________________________________________

Working from home has fostered the growth of the freelance job sector more than ever. More Canadians are taking on extra remote work to boost their yearly income. The rise of this growing sector means there are more opportunities, but the trick is finding these at-home gigs quickly and effectively without spending hours scrolling through pages of unsuitable job postings.

FlexJobs is the perfect platform to aid you in your search for jobs that fit your schedule, according to our content partner StackCommerce.

____________________________________________________

Today’s Posthaste was written by Pamela Heaven (@pamheaven), with files from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.